Updated on September 30th, 2024 by Bob Ciura

The Dividend Kings are the best-of-the-best in dividend longevity.

What is a Dividend King? A stock with 50 or more consecutive years of dividend increases.

The downloadable Dividend Kings Spreadsheet List below contains the following for each stock in the index among other important investing metrics:

- Payout ratio

- Dividend yield

- Price-to-earnings ratio

You can see the full downloadable spreadsheet of all 53 Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

The one requirement to be a Dividend King, is 50+ years of rising dividends.

But not all Dividend Kings make equally good investments today. Some Dividend Kings are better than others, based on the sustainability of their dividends.

With this in mind, we have analyzed the 10 safest Dividend Kings from our Sure Analysis Research Database with the safest dividends based on our Dividend Risk Score rating system.

The following 10 Dividend Kings have Dividend Risk Scores of A (our top rating), and the lowest payout ratios. As a result, they are the safest Dividend Kings for 2024.

Table of Contents

Safest Dividend Kings #10: MSA Safety Inc. (MSA)

MSA Safety Incorporated develops and manufactures safety products. Customers come from a variety of industrial markets, including oil & gas, fire service, construction, mining, and the military. MSA Safety’s major products include gas and flame detection, air respirators, head protection, fall protection, air purifying respirators, and eye protection gear.

On July 24th, 2024, MSA released its Q2 results for the period ending June 30th, 2024. For the quarter, revenue came in at $462.5 million, a 3.4% increase compared to Q2-2023.

More specifically, sales in the Americas segment were up 2%, while sales in the International segment rose by 7%. Adjusted earnings equaled $63 million compared to $54 million last year.

Importantly, the adjusted operating margin jumped to 21.3% compared to 19.4% in the same period a year ago, which makes for a significant expansion despite most industrial companies incurring rising costs lately.

Click here to download our most recent Sure Analysis report on MSA (preview of page 1 of 3 shown below):

Safest Dividend Kings #9: ABM Industries (ABM)

ABM Industries is a leading provider of facility solutions, which includes janitorial, electrical & lighting, energy solutions, facilities engineering, HVAC & mechanical, landscape & turf, and parking. ABM Industries has increased its dividend for 56 consecutive years.

ABM Industries reported its third quarter earnings results on September 6. The company announced that its revenues totaled $2.1 billion during the quarter, which was up 3% versus the previous year’s quarter and which beat estimates.

The revenue performance was stronger than during the previous quarter, in which revenues had been flat on a year-over-year basis. ABM Industries was able to keep its margins at the high level from the previous year’s quarter, as its EBITDA rose by 2%, almost in line with revenue.

ABM Industries was able to generate earnings-per-share of $0.94 during the third quarter, which beat the analyst consensus by $0.09. ABM Industries’ earnings-per-share were up by 19% versus the previous year’s quarter on an adjusted basis.

Click here to download our most recent Sure Analysis report on ABM (preview of page 1 of 3 shown below):

Safest Dividend Kings #8: S&P Global (SPGI)

S&P Global is a worldwide provider of financial services and business information and revenue of over $13 billion. Through its various segments, it provides credit ratings, benchmarks and indices, analytics, and other data to commodity market participants, capital markets, and automotive markets.

S&P Global has paid dividends continuously since 1937 and has increased its payout for 51 consecutive years.

S&P Global posted second quarter earnings on July 30th, 2024, and results were much better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $4.04, which was 39 cents better than estimates.

Earnings were up from $3.12 per share in last year’s Q2. Revenue soared 14.5% year-over-year to $3.55 billion, $140 million better than expected. Management also boosted guidance, and we’ve raised our estimate accordingly.

Expenses were $2.11 billion, the same as Q1, and up fractionally from last year’s Q2. Given revenue rose sharply, operating profit soared from $1.44 billion to $1.81 billion.

Revenue growth was strongest in the Ratings business, which saw revenue rise from $851 million to $1.14 billion year over-year. The Market Intelligence business is still the largest segment, but only just, as revenue rose modestly year over-year.

Click here to download our most recent Sure Analysis report on SPGI: (preview of page 1 of 3 shown below):

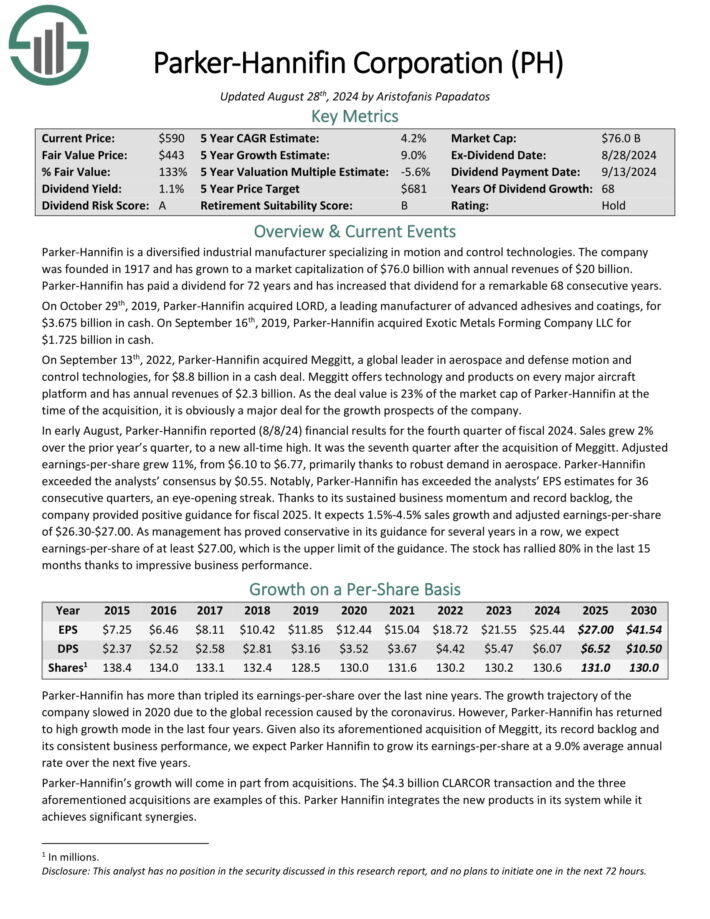

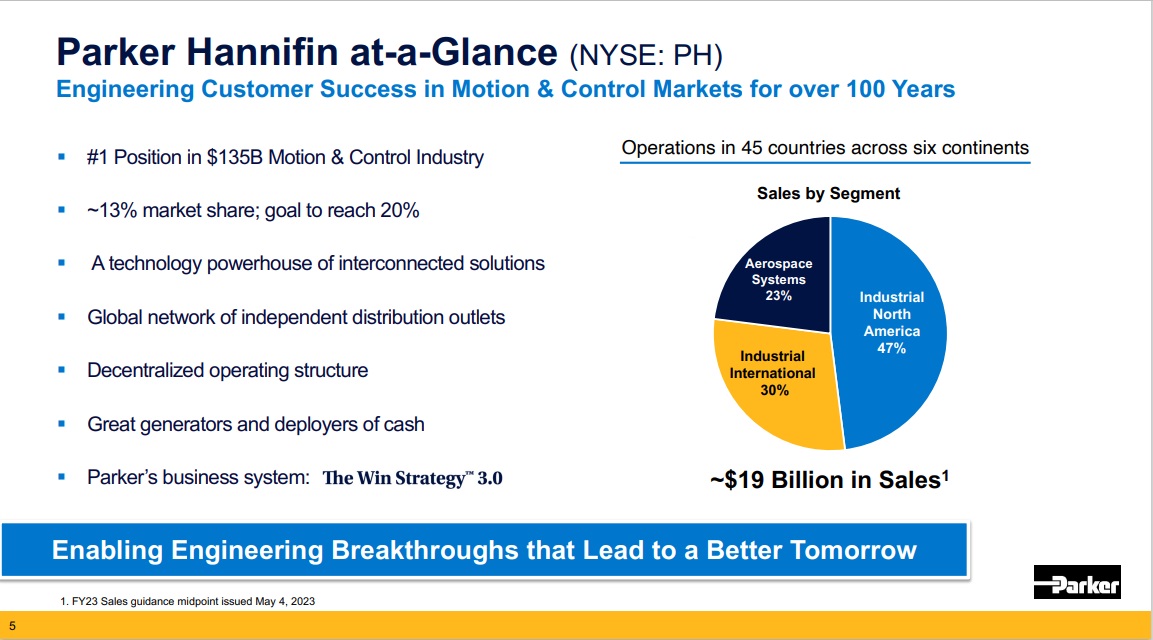

Safest Dividend Kings #7: Parker-Hannifin (PH)

Parker-Hannifin is a diversified industrial manufacturer specializing in motion and control technologies. The company generates annual revenues of $16 billion. Parker-Hannifin has paid a dividend for 72 years and has increased the dividend for 67 consecutive years.

Source: Investor Presentation

In early August, Parker-Hannifin reported (8/8/24) financial results for the fourth quarter of fiscal 2024. Sales grew 2% over the prior year’s quarter, to a new all-time high. It was the seventh quarter after the acquisition of Meggitt.

Adjusted earnings-per-share grew 11%, from $6.10 to $6.77, primarily thanks to robust demand in aerospace. Parker-Hannifin exceeded the analysts’ consensus by $0.55. Notably, Parker-Hannifin has exceeded the analysts’ EPS estimates for 36 consecutive quarters.

Click here to download our most recent Sure Analysis report on Parker-Hannifin (preview of page 1 of 3 shown below):

Safest Dividend Kings #6: Dover Corporation (DOV)

Dover Corporation is a diversified global industrial manufacturer with annual revenues of nearly $9 billion. Dover is composed of five reporting segments: Engineered Systems, Clean Energy & Fueling, Pumps & Process Solutions, Imaging & Identification, and Climate & Sustainability Technologies.

Slightly more than half of revenues come from the U.S., with the remainder coming from international markets.

On July 25th, 2024, Dover announced second quarter results the period ending June 30th, 2024. For the quarter, revenue grew 3.8% to $2.18 billion, which was $30 million more than expected. Adjusted earnings-per-share of $2.36 compared favorably to $2.05 in the prior year and was $0.15 above estimates.

Organic revenue improved 5% year-over-year while bookings grew 16%. For the quarter, Engineered Products had organic growth of 20% due to continued strong demand for waste handling and aerospace and defense products.

Click here to download our most recent Sure Analysis report on DOV (preview of page 1 of 3 shown below):

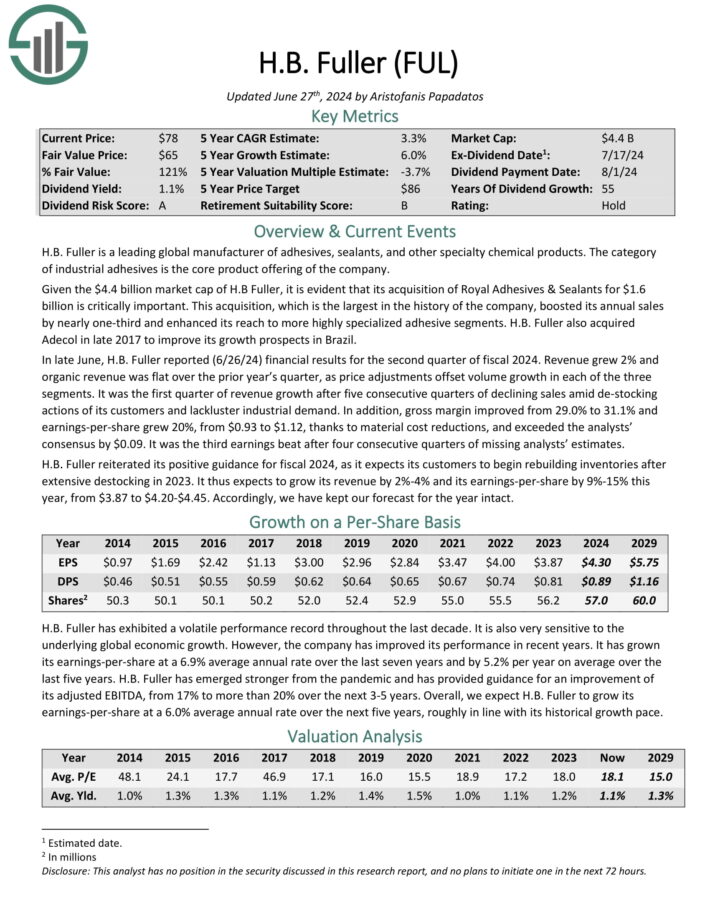

Safest Dividend Kings #5: H.B. Fuller (FUL)

H.B. Fuller is a leading global manufacturer of adhesives, sealants, and other specialty chemical products. The category of industrial adhesives is the core product offering of the company.

In late June, H.B. Fuller reported (6/26/24) financial results for the second quarter of fiscal 2024. Revenue grew 2% and organic revenue was flat over the prior year’s quarter, as price adjustments offset volume growth in each of the three segments.

It was the first quarter of revenue growth after five consecutive quarters of declining sales amid de-stocking actions of its customers and lackluster industrial demand.

In addition, gross margin improved from 29.0% to 31.1% and earnings-per-share grew 20%, from $0.93 to $1.12, thanks to material cost reductions, and exceeded the analysts’ consensus by $0.09.

Click here to download our most recent Sure Analysis report on H.B. Fuller (preview of page 1 of 3 shown below):

Safest Dividend Kings #4: W.W. Grainger (GWW)

W.W. Grainger, headquartered in Lake Forest, IL, is one of the world’s largest business-to-business distributors of maintenance, repair, and operations (“MRO”) supplies.

On July 31st, 2024, W.W. Grainger reported its Q2 results for the period ending June 30th, 2024. Revenues came in at $4.3 billion, up 3.1% on a reported basis and up 5.1% on a daily, constant currency basis (adjusted) compared to last year.

Results were driven by solid performance across the board. The High-Touch Solutions segment achieved sales growth of 3.1% due to solid volume growth in all geographies. In the Endless Assortment segment, sales were up 3.3%.

Growth was again driven by B2B customers across the segment as well as enterprise customer growth, partially offset by declining sales to non-core, consumer-like customers.

Click here to download our most recent Sure Analysis report on GWW (preview of page 1 of 3 shown below):

Safest Dividend Kings #3: Tennant Co. (TNC)

Tennant Company is a machinery company that produces cleaning products and offers cleaning solutions to its customers. In the US, the company holds the market leadership position in its industry, but it also sells its products in more than 100 additional countries around the globe.

Source: Investor Presentation

Tennant Company reported its second quarter earnings results on August 8. The company announced that it generated revenues of $331 million during the quarter, which was 3% more than the top line number from the previous year’s quarter.

This was slightly better than the recent trend, as revenue had grown less on a year-over-year basis during the previous quarter. Revenues were higher compared to what the analyst community had forecasted.

Tennant Company generated adjusted earnings-per-share of $1.83 during the second quarter, which was more than what the analyst community had forecasted, and which was down 2% compared to the previous year.

Management is forecasting that adjusted earnings-per-share will fall into a range of $6.15 to $6.55 in 2024.

Click here to download our most recent Sure Analysis report on Tennant Company (preview of page 1 of 3 shown below):

Safest Dividend Kings #2: Nucor Corp. (NUE)

Nucor is the largest publicly traded US-based steel corporation. The steel industry is notoriously cyclical, which makes Nucor’s streak of 51 consecutive years of dividend increases even more remarkable.

Nucor Corporation reported its financial results for the second quarter of 2024, demonstrating strong performance amidst challenging market conditions.

The company posted net earnings of $645.2 million, or $2.68 per diluted share, with net sales totaling $8.08 billion. Net earnings before noncontrolling interests were $712.1 million, and EBITDA reached $1.23 billion.

Click here to download our most recent Sure Analysis report on NUE (preview of page 1 of 3 shown below):

Safest Dividend Kings #1: Farmers & Merchants Bancorp (FMCB)

Farmers & Merchants Bancorp is a locally owned and operated community bank with 32 locations in California. Due to its small market cap and its low liquidity, it passes under the radar of most investors. F&M Bank has paid uninterrupted dividends for 88 consecutive years and has raised its dividend for 58 consecutive years.

In mid-July, F&M Bank reported (7/17/24) financial results for the second quarter of fiscal 2024. The bank grew its adjusted earnings-per-share 5% over the prior year’s quarter, from $28.03 to $29.39. It posted 5% growth of loans and flat deposits.

Net interest income dipped -3% due to a contraction of net interest margin from 4.28% to 3.91% amid higher deposit costs. Management remains optimistic for the foreseeable future, as the bank enjoys one of the widest net interest margins in its sector.

Click here to download our most recent Sure Analysis report on FMCB (preview of page 1 of 3 shown below):

Final Thoughts

The Dividend Kings are a group of high-quality businesses with shareholder-friendly management teams that have strong competitive advantages.

Purchasing businesses with these characteristics at fair or better prices and holding them for long periods of time will likely result in strong long-term investment performance.

The 10 stocks presented in this article have the highest Dividend Risk scores in our database, as well as the lowest dividend payout ratios. As a result, they are the safest Dividend Kings.

Screening to find the safest Dividend Kings is not the only way to find high-quality dividend growth stock ideas.

Sure Dividend maintains similar databases on the following useful universes of stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.