Published on December 20th, 2024 by Bob Ciura

Spreadsheet data updated daily

Micro-cap stocks are publicly-traded companies with market capitalizations between $50 million and $300 million. These represent the smallest companies in the stock market.

The total number of micro-cap stocks varies depending upon market conditions. Right now there are hundreds of micro-cap stocks, so there are plenty for investors to choose from.

As the smallest stocks, micro-caps could have stronger growth potential over the long run than large-cap stocks or mega-cap stocks.

At the same time, micro-cap stocks carry a number of unique risk factors to consider.

You can download a free spreadsheet of all 1400+ micro cap stocks right now (along with important financial metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

The downloadable micro-cap stocks list above was curated from two leading micro-cap stock ETFs:

- iShares Micro-Cap ETF (IWC)

- First Trust Dow Jones Select Micro-Cap Index Fund (FDM)

This article includes a spreadsheet and table of all of our micro-cap stocks, as well as detailed analysis on our Top 10 micro-cap stocks today.

Keep reading to see the 10 best micro-cap stocks analyzed in detail.

The 10 Best Micro Cap Stocks Today

Now that we’ve defined what a micro-cap stock is, let’s take a look at the 10 best micro-cap stocks, as defined by our Sure Analysis Research Database.

The database ranks total expected annual returns, combining current yield, forecast earnings growth and any change in price from the valuation.

Note: The Sure Analysis Research Database is focused on income producing securities. As a result, we do not track or rank securities that don’t pay dividends. Micro-cap stocks that don’t pay dividends were excluded from the Top 10 rankings below.

We’ve screened the micro-cap stocks with the highest 5-year expected returns and have provided them below, ranked from lowest to highest.

You can instantly jump to any individual stock analysis by using the links below:

Micro Cap Stock #10: Parke Bancorp, Inc. (PKBK)

- 5-year expected annual returns: 11.4%

Parke Bancorp is a New Jersey-based regional bank. It serves customers in the South New Jersey and Greater New

York metro markets.

The bank has about $2 billion in total assets. About half its loan book consists of loans on single-family homes, primarily in the Philadelphia and Southern New Jersey area.

The bank has grown its deposit base at a 9.5% annualized rate over the past decade while increasing its gross loan book more than 10% annually.

That, combined with a gradually rising return on equity “ROE” metric over time, led to rapid growth in earnings-per-share. This, in turn, supported a tremendous 29% annualized dividend growth rate since 2014.

The bank’s Q3 earnings results, reported October 18th, 2024, showed significant improvement. Revenues grew at a 6.8% rate year-over-year to $33 million. Earnings per share rose to 62 cents per share from 57 cents per share in the same period of last year.

Click here to download our most recent Sure Analysis report on PKBK (preview of page 1 of 3 shown below):

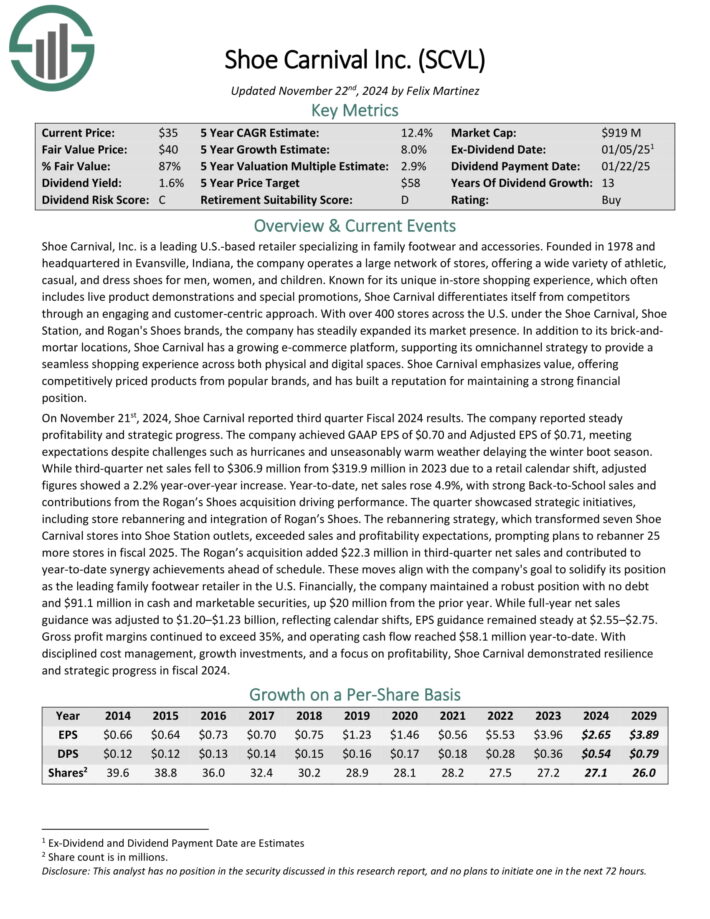

Micro Cap Stock #9: Shoe Carnival, Inc. (SCVL)

- 5-year expected annual returns: 11.4%

Shoe Carnival, Inc. is a leading U.S.-based retailer specializing in family footwear and accessories. The company operates a large network of stores, offering a wide variety of athletic, casual, and dress shoes for men, women, and children.

With over 400 stores across the U.S. under the Shoe Carnival, Shoe Station, and Rogan’s Shoes brands, the company has steadily expanded its market presence.

In addition to its brick-and mortar locations, Shoe Carnival has a growing e-commerce platform, supporting its omnichannel strategy.

On November 21st, 2024, Shoe Carnival reported third quarter Fiscal 2024 results. The company reported GAAP EPS of $0.70 and Adjusted EPS of $0.71, meeting expectations.

While third-quarter net sales fell to $306.9 million from $319.9 million in 2023 due to a retail calendar shift, adjusted figures showed a 2.2% year-over-year increase.

Year-to-date, net sales rose 4.9%, with strong Back-to-School sales and contributions from the Rogan’s Shoes acquisition driving performance.

Click here to download our most recent Sure Analysis report on SCVL (preview of page 1 of 3 shown below):

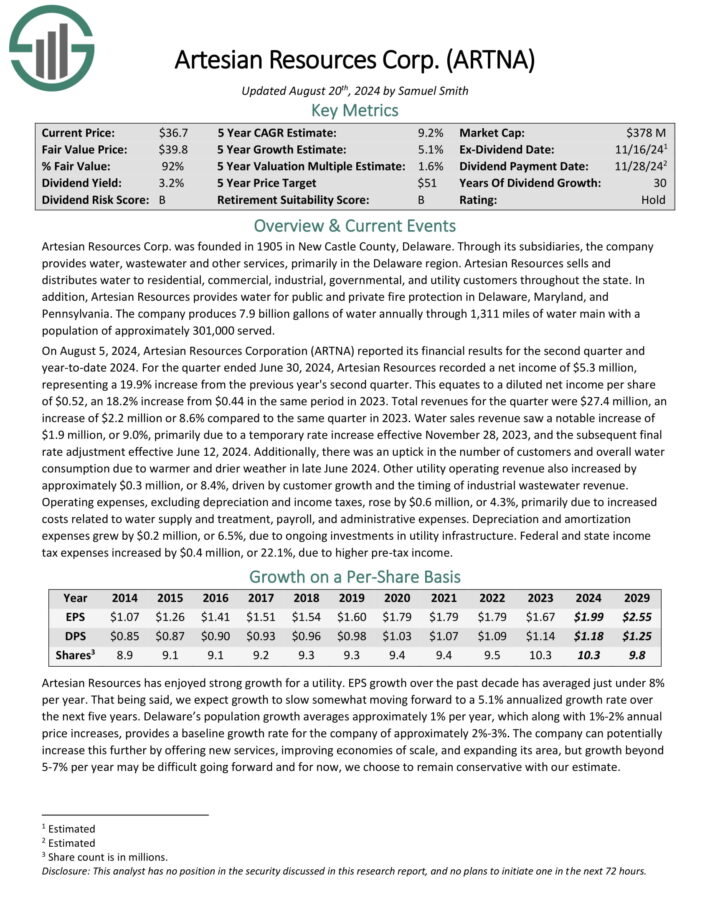

Micro Cap Stock #8: Artesian Resources (ARTNA)

- 5-year expected annual returns: 11.5%

Artesian Resources Corp. was founded in 1905 in New Castle County, Delaware. Through its subsidiaries, the company provides water, wastewater and other services, primarily in the Delaware region.

Artesian Resources sells and distributes water to residential, commercial, industrial, governmental, and utility customers throughout the state.

In addition, Artesian Resources provides water for public and private fire protection in Delaware, Maryland, and Pennsylvania. The company produces 7.9 billion gallons of water annually through 1,311 miles of water main with a population of approximately 301,000 served.

On August 5, 2024, Artesian Resources Corporation (ARTNA) reported its financial results for the second quarter and year-to-date 2024. For the quarter ended June 30, 2024, Artesian Resources recorded a net income of $5.3 million, representing a 19.9% increase from the previous year’s second quarter.

This equates to a diluted net income per share of $0.52, an 18.2% increase from $0.44 in the same period in 2023. Total revenues for the quarter were $27.4 million, an increase of $2.2 million or 8.6% compared to the same quarter in 2023.

Click here to download our most recent Sure Analysis report on ARTNA (preview of page 1 of 3 shown below):

Micro Cap Stock #7: Timberland Bancorp (TSBK)

- 5-year expected annual returns: 11.8%

Timberland Bancorp is a Hoquiam, Washington-based regional bank. It has enjoyed strong growth in recent years, both from growth in its core market along with the bank’s expansion in business and merchant services.

It operates 23 bank branches today, all in Washington, serving both rural areas and some communities in the greater Seattle metropolitan area.

Timberland has a lending book weighted toward commercial credits, with more than half its loans being in either commercial real estate or construction lending.

On October 31st, 2024, Timberland reported its fiscal fourth quarter 2024 earnings. Earnings per share of 79 cents slipped slightly from 81 cents in the same period of 2023, but rose sequentially from Q3. Timberland reported an uptick in loan volumes, deposits, and net interest margin.

Click here to download our most recent Sure Analysis report on TSBK (preview of page 1 of 3 shown below):

Micro Cap Stock #6: Plymouth Industrial REIT (PLYM)

- 5-year expected annual returns: 12.4%

Plymouth Industrial REIT is a full-service, vertically integrated real estate investment trust which acquires, owns, and manages single and multi-tenant industrial properties, which include distribution centers, warehouses, light industrial and small bay industrial properties.

The majority of its property portfolio is located in Florida, Ohio, Indiana, Tennessee, Illinois, and Georgia. As of June 30, 2024, the trust owned and managed 210 buildings, totaling 33.8 million square feet in over 10 markets.

The property portfolio resides almost entirely within The Golden Triangle states, which is within a day’s drive to 70% of the U.S. population, and contains more ports than any other region in the country.

Plymouth Industrial reported third quarter 2024 results on November 6th, 2024. The trust reported core funds from operations (FFO) of $0.44 per common share, down two cents compared to last year.

Adjusted FFO per share of $0.40 was a 4.8% decrease compared to Q3 2023. Same store net operating income (NOI) on a cash basis rose by 0.6% year-over-year when excluding early termination income.

Click here to download our most recent Sure Analysis report on PLYM (preview of page 1 of 3 shown below):

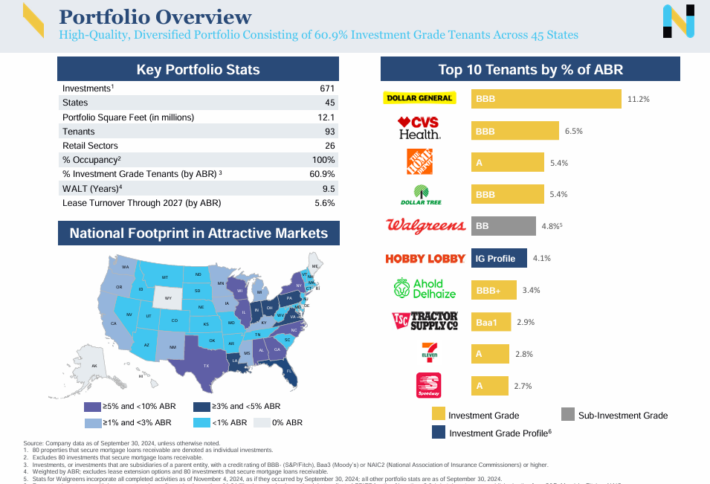

Micro Cap Stock #5: NETSTREIT Corp. (NTST)

- 5-year expected annual returns: 13.2%

Netstreit Corp is a REIT which acquires, owns, and manages a diversified portfolio of single-tenant, retail commercial real estate.

The property portfolio focuses on leasing to tenants where brick and mortal is critical, such as essential services in the retail sector, and is spread across 45 states and over 25 retail sectors.

Netstreit’s top five tenants by annualized base rent are Dollar General, CVS, Home Depot, Dollar Tree, and Walgreens.

Source: Investor Presentation

On November 4th, 2024, Netstreit reported third quarter 2024 results for the period ending September 30th, 2024. The trust reported core FFO and AFFO per share of $0.32 for the quarter.

AFFO was 3% higher compared to $0.31 earned in Q3 2023. During Q3, Netstreit completed $152 million in investment activity, a new quarterly record, at a blended cash yield of 7.5% across 33 investments. It also made eight disposition for $24 million in proceeds.

Click here to download our most recent Sure Analysis report on NTST (preview of page 1 of 3 shown below):

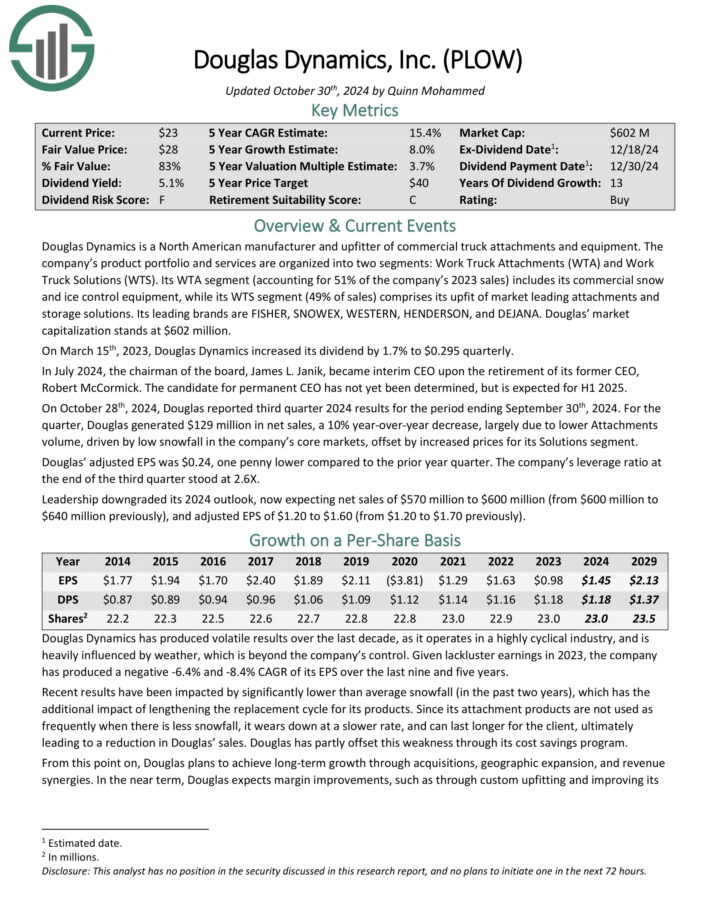

Micro Cap Stock #4: Douglas Dynamics, Inc. (PLOW)

- 5-year expected annual returns: 13.6%

Douglas Dynamics is a North American manufacturer and upfitter of commercial truck attachments and equipment. The company’s product portfolio and services are organized into two segments: Work Truck Attachments (WTA) and Work Truck Solutions (WTS).

Its WTA segment (accounting for 51% of the company’s 2023 sales) includes its commercial snow and ice control equipment, while its WTS segment (49% of sales) comprises its upfit of market leading attachments and storage solutions. Its leading brands are FISHER, SNOWEX, WESTERN, HENDERSON, and DEJANA.

On October 28th, 2024, Douglas reported third quarter 2024 results. For the quarter, Douglas generated $129 million in net sales, a 10% year-over-year decrease.

The sales decline was largely due to lower attachments volume, driven by low snowfall in the company’s core markets, offset by increased prices for its Solutions segment.

Douglas’ adjusted EPS was $0.24, one penny lower compared to the prior year quarter. The company’s leverage ratio at the end of the third quarter stood at 2.6X.

Click here to download our most recent Sure Analysis report on PLOW (preview of page 1 of 3 shown below):

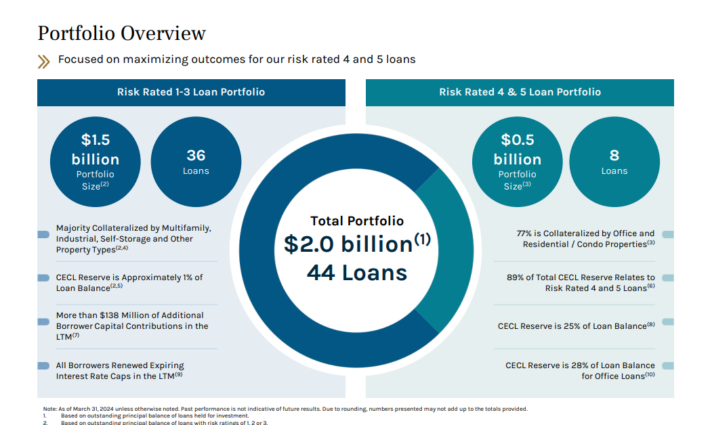

Micro Cap Stock #3: Ares Commercial Real Estate (ACRE)

- 5-year expected annual returns: 13.7%

Ares Commercial Real Estate Corporation is a specialty finance company primarily engaged in originating and investing in commercial real estate (“CRE”) loans and related investments. ACRE generated around $198.6 million in interest income last year.

The company’s loan portfolio (98% of which are senior loans) comprises 44 market loans across 8 asset types, with an outstanding principal balance of $2 billion. The majority of the loans are tied to multifamily, office, and mixed-use properties.

Source: Investor Presentation

In terms of geographical diversification, ACRE’s exposure features a healthy mix between the Southeast, West, and Midwest.

On November 7th, 2024, ACRE reported its Q3 results for the period ending September 30th, 2024. Interest income came in at $39.3 million, 26% lower year-over-year, with commercial real estate continuing to struggle.

In the meantime, interest expense fell by 8% to about $27.4 million. Thus, total revenues (interest income – interest expenses + $4.7 million in revenue from ACRE’s own real estate) fell by about 30% to roughly $16.7 million. Total expenses rose by about 41% to $9.3 million, primarily due to higher expenses from real estate owned previously absent.

Click here to download our most recent Sure Analysis report on ACRE (preview of page 1 of 3 shown below):

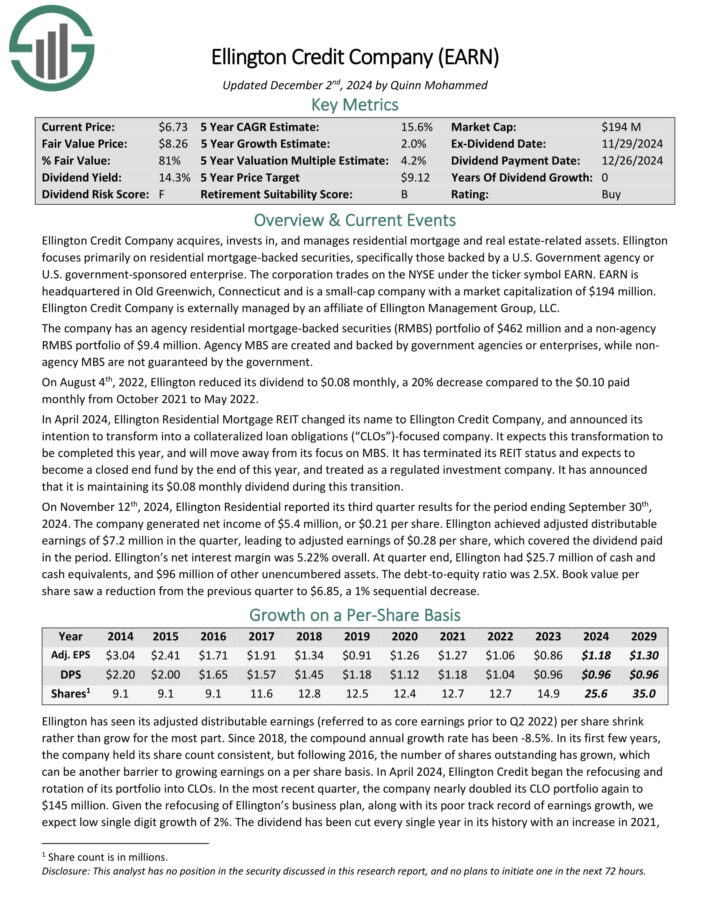

Micro Cap Stock #2: Ellington Credit Co. (EARN)

- 5-year expected annual returns: 16.2%

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

Source: Investor Presentation

On November 12th, 2024, Ellington Residential reported its third quarter results for the period ending September 30th, 2024. The company generated net income of $5.4 million, or $0.21 per share.

Ellington achieved adjusted distributable earnings of $7.2 million in the quarter, leading to adjusted earnings of $0.28 per share, which covered the dividend paid in the period.

Net interest margin was 5.22% overall. At quarter end, Ellington had $25.7 million of cash and cash equivalents, and $96 million of other unencumbered assets.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

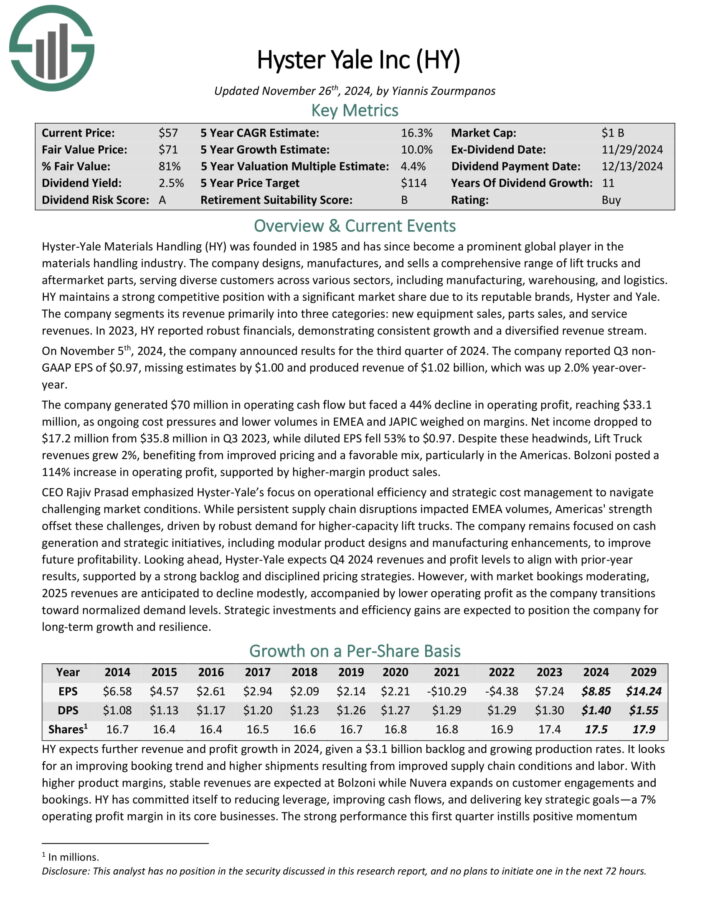

Micro Cap Stock #1: Hyster Yale Inc. (HY)

- 5-year expected annual returns: 18.3%

Hyster-Yale Materials Handling operates in the materials handling industry. The company designs, manufactures, and sells a comprehensive range of lift trucks and aftermarket parts, serving diverse customers across various sectors, including manufacturing, warehousing, and logistics.

HY maintains a strong competitive position with a significant market share due to its reputable brands, Hyster and Yale. The company segments its revenue primarily into three categories: new equipment sales, parts sales, and service revenues. In 2023, HY reported robust financials, demonstrating consistent growth and a diversified revenue stream.

On November 5th, 2024, the company announced results for the third quarter of 2024. The company reported Q3 non GAAP EPS of $0.97, missing estimates by $1.00 and produced revenue of $1.02 billion, which was up 2.0% year-over year.

The company generated $70 million in operating cash flow but faced a 44% decline in operating profit, reaching $33.1 million, as ongoing cost pressures and lower volumes in EMEA and JAPIC weighed on margins. Net income dropped to $17.2 million from $35.8 million in Q3 2023, while diluted EPS fell 53% to $0.97.

Click here to download our most recent Sure Analysis report on HY (preview of page 1 of 3 shown below):

Final Thoughts

Micro-cap stocks are the smallest companies currently trading on the stock market. The potential benefit of investing in micro-cap stocks is the potential for higher growth, and shareholder returns, over time.

Of course, investors need to carefully consider the unique risks associated with investing in micro-cap stocks. The 10 micro-cap stocks on this list all pay dividends to shareholders and have positive expected returns.

As a result, these 10 micro-cap stocks could be attractive for dividend growth investors.

Other Dividend Lists

The following lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats List is comprised of 66 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~400 NASDAQ stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 53 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.