Solo 401(k) plans are a popular retirement savings vehicle for self-employed business owners. One of their key features is the ability to make contributions both as an “employee” of the business and as the “employer”, i.e., the business itself. By maximizing both the employee employer contributions, solo 401(k) plan owners can often save significantly more than is possible with other types of retirement plans available to self-employed workers, like SEPs and standard IRAs.

The tax treatment for solo 401(k) plan contributions can range from traditional (pre-tax) to Roth to after-tax (i.e., a nondeductible contribution that can be converted to Roth tax-free). With the caveat, however, that the types of tax treatment available depend on whether the funds are coming from the “employee” or “employer” part of the contribution. Employee contributions can be made on a pre-tax, Roth, or after-tax basis, or a combination of all three. But historically, contributions from the employer side could only be made on a pre-tax basis.

In 2022, the SECURE 2.0 Act included a provision that changed the rules for 401(k) plans (including solo 401(k)s) that for the first time allowed employer contributions to be made on a Roth basis. Although the rule technically took effect immediately after SECURE 2.0’s passage, it took until late 2023 to issue guidance on how Roth employer contributions should be reported for tax purposes.

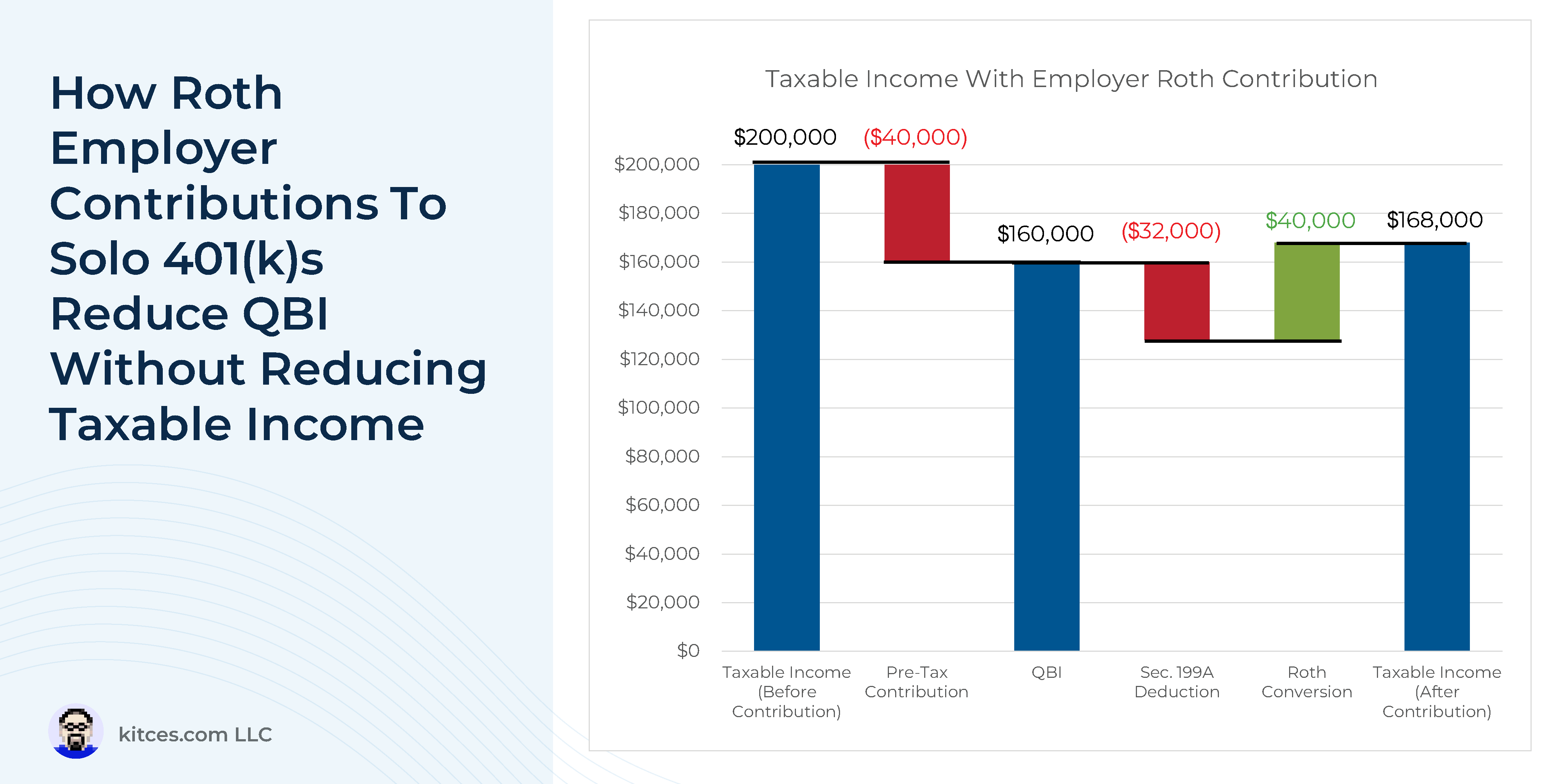

According to the IRS’s guidance, Roth employer contributions to a 401(k) plan are effectively required to be reported as if the contribution had been made on a pre-tax basis, and then immediately converted to Roth. Which makes sense in that it doesn’t require wholesale changes to existing tax forms or payroll systems, but does have an unintended side effect for self-employed owners of solo 401(k) and SEP plans who are also eligible for the Sec. 199A deduction for Qualified Business Income (QBI): Because the business’s QBI is reduced by the amount of any deductible retirement plan contribution, the fact that Roth employer contributions are reported initially as deductible contributions mean that they reduce the business owner’s Sec. 199A deduction, even though they don’t actually reduce their taxable income (since the income from the Roth contribution is added back in the form of the “phantom” Roth conversion as required by the IRS’s guidance).

Accordingly, business owners who contribute to a solo 401(k) or SEP plan and are also eligible for the Sec. 199A deduction may want to avoid making Roth employer contributions, even if their plan provider allows it. Fortunately, however, there is another way to maximize Roth contributions to a solo 401(k) plan that doesn’t affect QBI in any way: If the plan allows employee contributions to be made on an after-tax basis, the business owner can simply make after-tax contributions (all the way up to the $69,000 total contribution limit) and convert them to Roth, which is a tax-free transaction since the contributions weren’t deductible to begin with. And because there’s no deduction for the contribution, it won’t affect the QBI calculation in any way.

The key point is that, as business owners decide on their solo 401(k) contributions for the year, they may be unaware of the effects that making Roth employer contributions might have on their Sec. 199A deductions. For advisors, then, making sure that business owners clients are aware of these effects, and giving guidance on how to work around them via after-tax employee contributions, can ensure that they get the maximum benefit from their Roth solo 401(k) savings!