A reader asks:

If Bill Sweet’s favorite topic is Roth IRA’s/401K’s, I’d bet his second favorite is tax gain harvesting (in a taxable account). For 2024, individuals with taxable income below $47,025 ($94,050 for married couples) pay 0% tax for long-term capital gains (LTCG). In years when you’re under the threshold you could effectively lock in tax-free long-term gains. The idea would be to realize just enough LTCG to stay within the 0% tax bracket. I think this topic would be beneficial to the listeners to keep in mind as they head into the new year with their tax planning. Maybe Bill could chime in and add some of his insights/thoughts on this topic.

Ask and you shall receive!

I am not a tax person so that’s why I outsource to a professional. Bill Sweet is my personal tax guru and the head of our tax team at Ritholtz Wealth Management. Bill came on Ask the Compound this week to answer this question for us.

This topic is especially relevant for retirees taking withdrawals from their portfolios.

Our reader actually undersells the deal on long-term capital gains here. You also have to tack on the standard deduction which is $15,000 for individuals or $30,000 for a married couple.

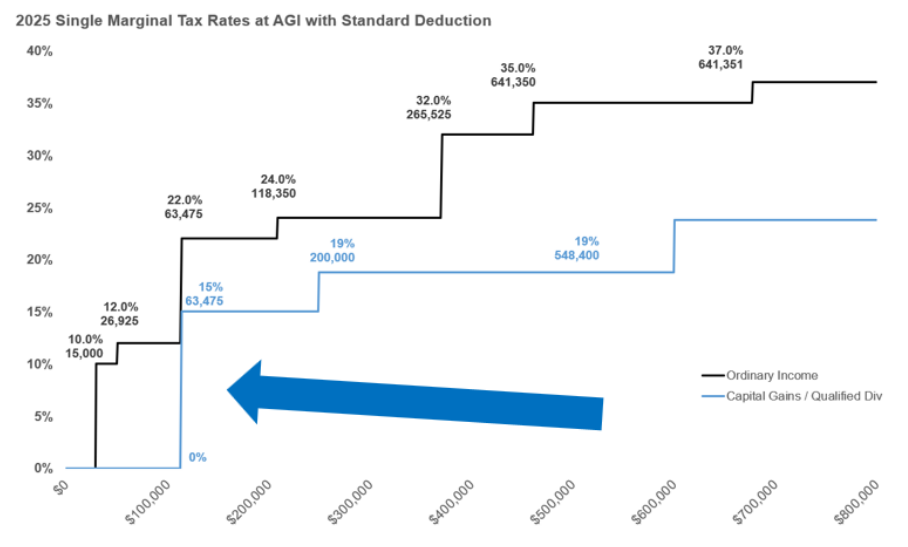

Take a look at this handy chart Bill made for me:

That means don’t have to pay federal income taxes on your long-term capital gains until your income exceeds a little more than $63,000. So you could realize more than $63,000 in capital gains and dividends without paying any federal income tax.1

Not bad.

Income also included things like Social Security, pension income, part-time jobs, etc. But for the sake of keeping things simple, let’s look at a few examples to see how this would play out at various levels of spending from a portfolio.

Tax situations are always circumstantial so I’m going to use round numbers so it’s not too complicated.

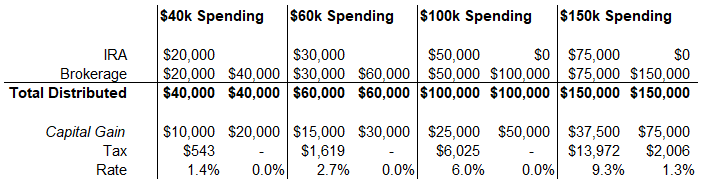

Let’s say you have a $1 million portfolio and use the 4% rule to take $40k of spending in your first year of retirement. And we can further assume you take half of your distributions from a traditional IRA ($20k) and half from a taxable account ($20k). For the brokerage account, we’ll also figure half of it is capital gains and the other half is the cost basis.

In this scenario, you’re paying nothing in capital gains. After your standard deduction you would end up paying a small amount (around $500) in taxes but it’s a rate of less than 1.5% on your $40k in spending.

Mr. Sweet was kind enough to draft some other examples at various spending levels as well:

You can see those long-term capital gain taxes didn’t kick in until the gains were $75k. And even then it was a negligible amount.

The usual caveats apply here — you could change where the money comes from (we didn’t use any Roth assets in this equation), change the types of investments used, change the income profile, etc.2 But even if you use these numbers as ballpark figures, taxes will likely be less of a burden in retirement than many people think.

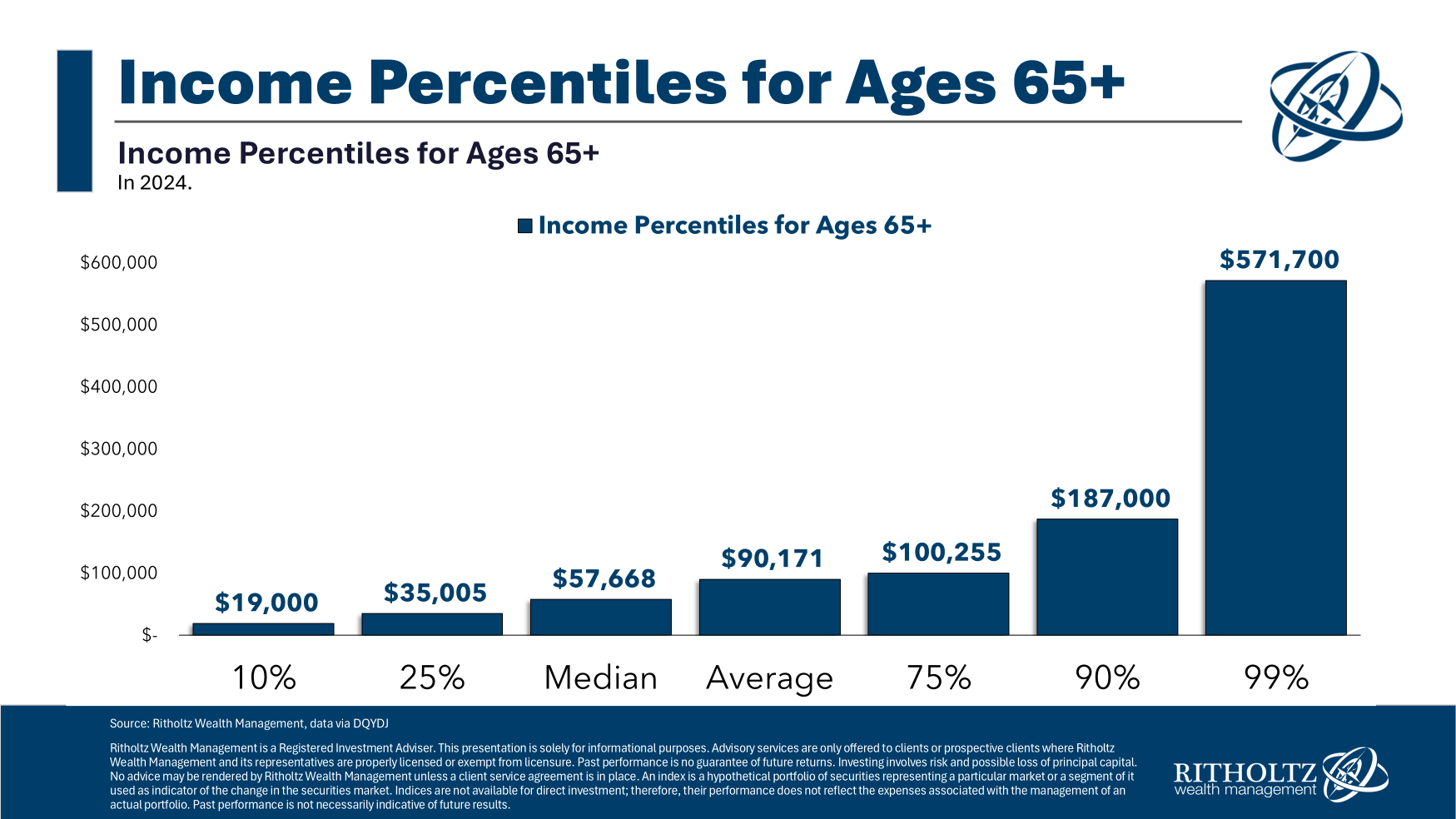

Some wealthy people who spend a lot of money might look at these numbers and scoff but check out the income percentiles for people who are 65 and older:

Three-quarters of this cohort has an annual income of $100k or less.

Taxes might not be as bad as you think in retirement.

Bill joined me on Ask the Compound this week to tackle this one along with questions about when to sell a concentrated stock position before retirement, how direct indexing works, the use of margin to avoid selling appreciated securities and asset location for your fun trading account.

Further Reading:

The Inheritance Battle

1State tax rules vary by state so that’s a consideration as well. These numbers are just Federal taxes.

2This is why it’s so important to utilize a tax professional if you can.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.