The U.S. economy has entered Rasputin territory — it just refuses to die.

Every time there is something for people to worry about — war, inflation, commercial real estate, the Fed raising rates, softening labor markets, etc. — the economy takes it on the chin and keeps moving forward.

Today we got another solid jobs report. The unemployment rate actually ticked down again to 4.1% and has been remarkably consistent.1

It seems almost silly at this point to worry about the most dynamic economy in the world.

The fact that the Fed has been cutting rates should help things even more.

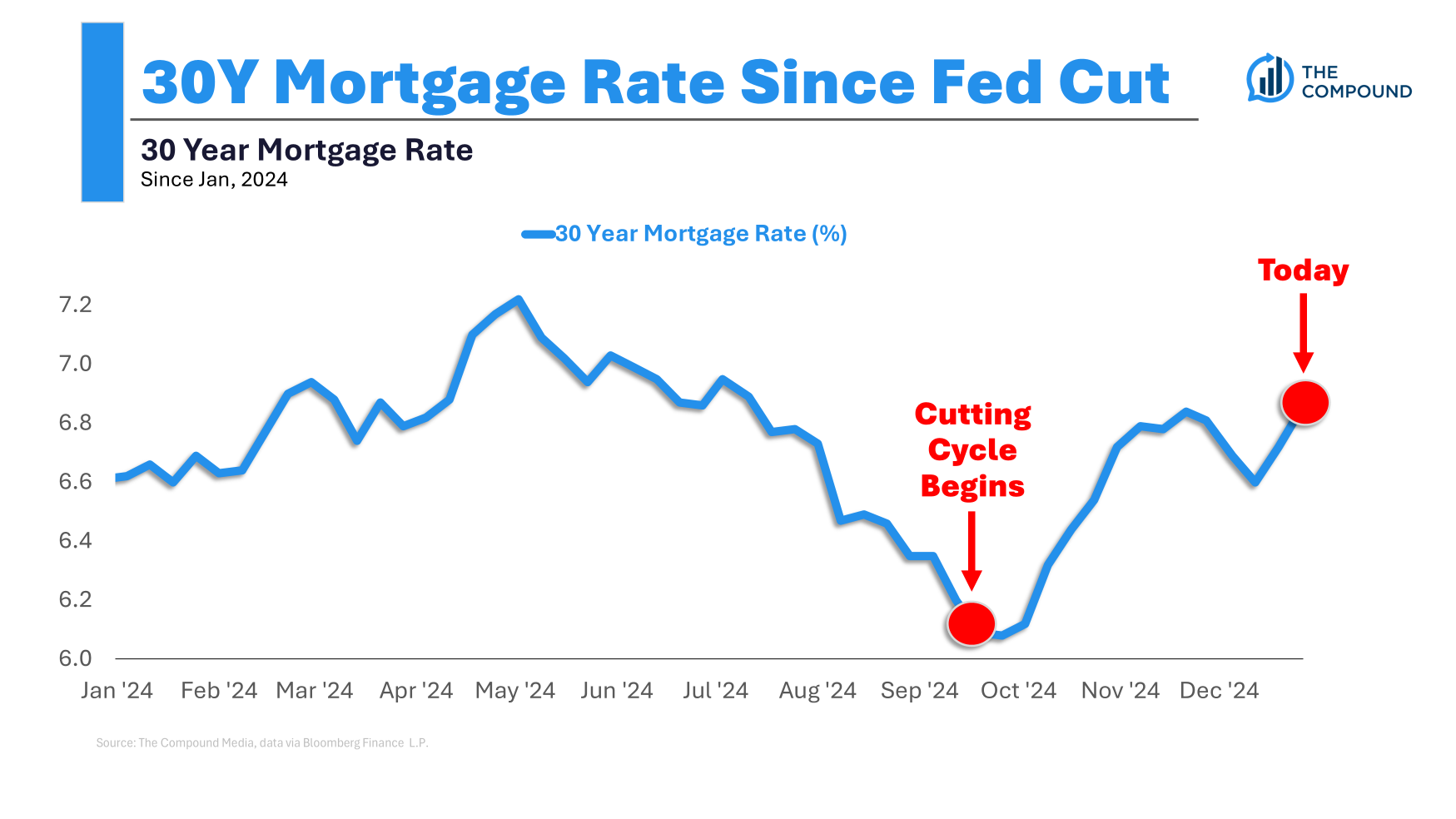

The problem is that while short-term rates on savings accounts, money markets, CDs, T-bills and the like have gone down, borrowing costs have gone up since the Fed started the current cutting cycle.

This one concerns me the most:

Everyone keeps waiting for lower mortgage rates that never transpire.

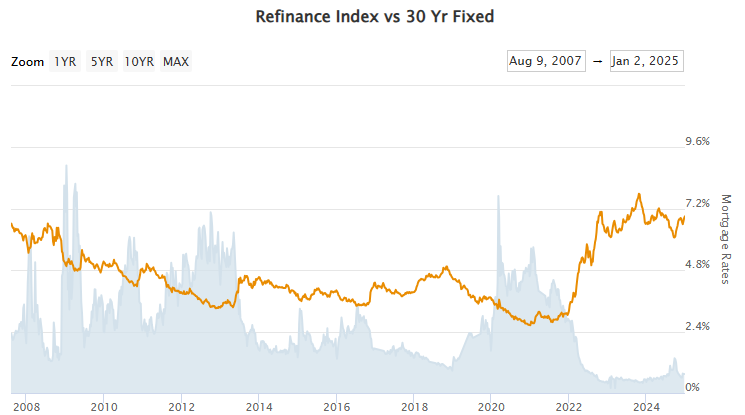

Mortgage rates have been above 6% for two-and-a-half years now and it hasn’t really mattered all that much.2 Housing prices continue to hit new all-time highs because so many homeowners locked in 3% mortgages during the pandemic.

There has been some housing activity in recent years but 55% of all homeowners still have a mortgage rate under 4% while nearly three-quarters of borrowings are under 5%.

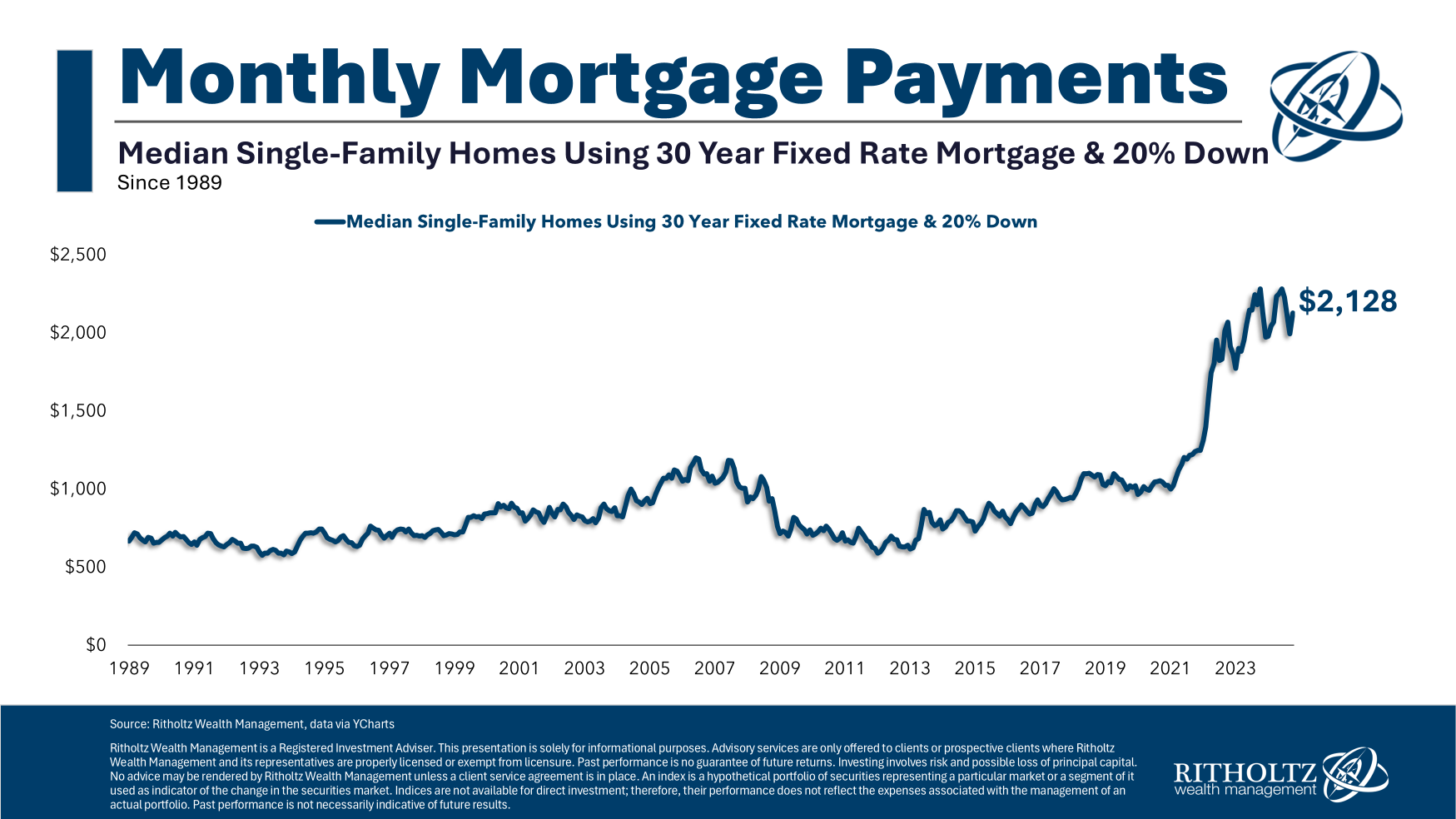

This, of course, makes it difficult for homeowners to buy a new place because the mortgage payments would be so much higher. Just look at the change in average monthly payments since the start of this decade:

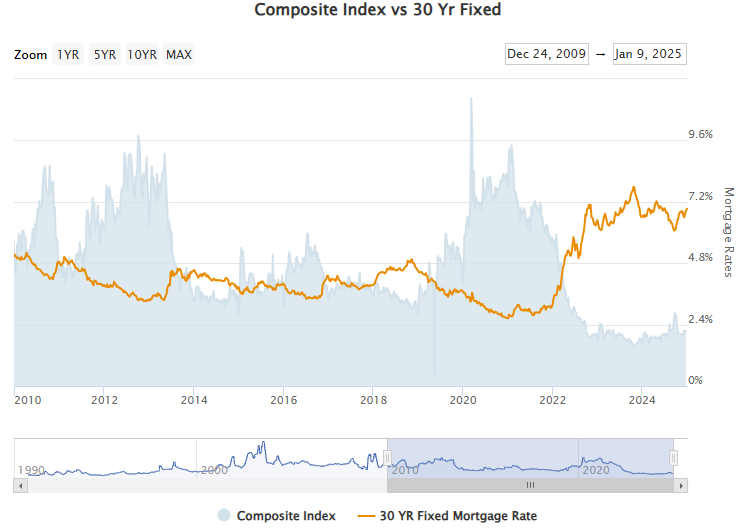

This all happened so fast it makes sense that there are fewer housing transactions. Just look at the index of mortgage applications over time versus mortgage rates:

No one is refinancing either:

I’ve chronicled my worries about this many times in the past. First-time homebuyers got a raw deal. They are dealing with higher housing prices and higher borrowing costs concurrently through no fault of their own.

But beyond homebuyers, my biggest concern now is what happens to the rest of the housing industry if the current situation persists.

Can you imagine being a realtor in this environment where transaction activity has fallen off a cliff? Or how about a loan originator?

Housing activity touches so many other areas as well. When you buy a home you pay for realtor fees and closing costs but also movers, inspections, appraisals, new furniture, decorations, lawncare, etc. Plus, in the homebuilding process you have construction workers, materials, suppliers and permits.

Luke Kawa at Sherwood news wrote a piece recently about how housing IS the business cycle:

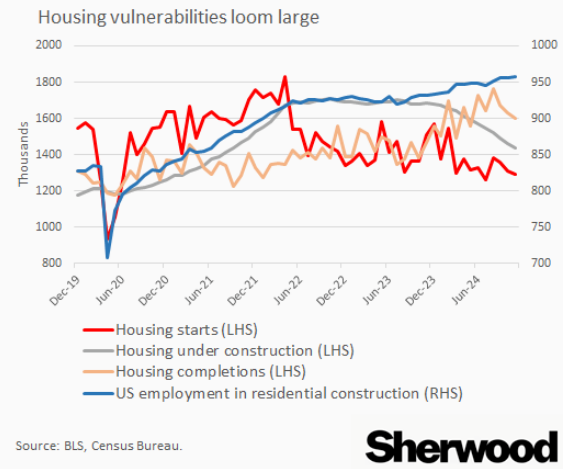

In a world where prospective new buyers are deterred by high long-term interest rates, homebuilders are facing pressure on margins thanks in part to trying to subsidize some of this rate sticker shock, and with management of these firms warning of lower-than-expected deliveries in the first quarter of 2025, employment in residential construction stands out as a clear vulnerability for the US job market.

Given the old maxim “housing is the business cycle,” popularized by a well-timed 2007 paper by Ed Leamer of the same name, that means it’s an important flashpoint for the US economy and financial markets as well.

Here’s a good chart from the piece showing how activity is rolling over:

Luckily, the labor market remains strong but I don’t see how that can last unless more current homeowners do renovations.

If you add up all of the components that are directly or indirectly tied to the housing market, it makes up something like 20% of GDP.

So far that hasn’t mattered to the overall economy but it has to eventually if the status quo remains.

The good news is the reason for higher mortgage rates right now is because the economy remains strong.

The bad news is it will probably take a weaker economy to bring rates down to a level that induces more activity in the housing market.

Ironically, the cure for high mortgage rates might be high mortgage rates if they continue to act as a drag on the economy.

Michael and I talked about mortgage rates, the housing market and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The Biggest Risk in Real Estate

Now here’s what I’ve been reading lately:

Books:

1These are the past 8 unemployment readings: 4.0%, 4.1%, 4.2%, 4.2%, 4.1%, 4.1%, 4.2% and 4.1%.

2Some people like to point out today’s rates are close to the long-term averages. And it is true that the average mortgage rate since 1970 is more than 7%. But homebuyers in the past weren’t dealing with housing prices that went up 50% in a 4 year period.