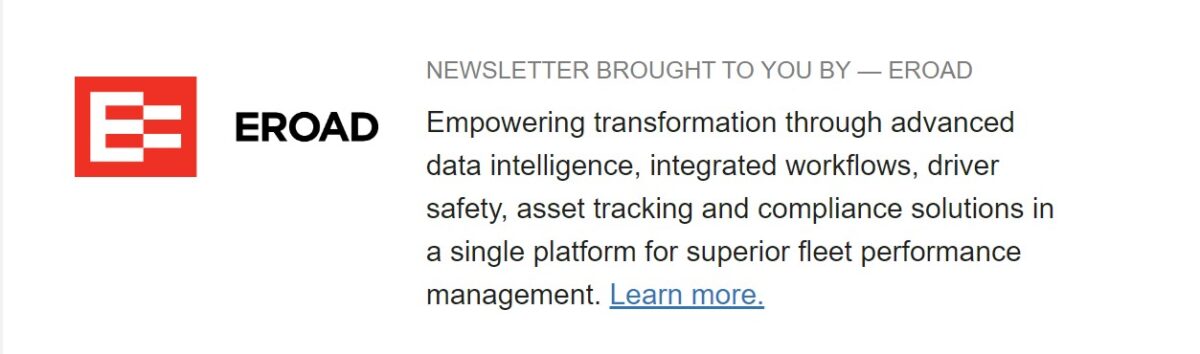

November trailer orders rise but remain below expectations

Recent trailer data released by ACT Research and FTR Transportation Intelligence showed net trailer orders improving compared to October but below seasonal expectations, as fleets prioritize spending on Class 8 tractors. ACT Research reported November net trailer orders rose 23% to 20,800 units. Year-to-date orders are at 139,100 units, down 34% compared to November 2023’s total ytd orders at 211,000 bookings. While bookings rose, so did the order backlog. Jennifer McNealy, director – CV market research and publications at ACT Research, said in the release, “For the first time in nearly a year, order intake outpaced build, and by about 6,700 units. As a result, backlogs expanded almost 11% sequentially in November.”

McNealy added that while order quoting activity increased, the data continues to point to macroeconomic headwinds impacting carriers, “with OEMs struggling to keep current operations intact, against a much more competitive landscape compared to the past several years as the entire industry competes to book business. Simultaneously, strong Class 8 equipment purchases continue to oversupply the market, thereby dampening for-hire freight rates and limiting capex for new trailers.”

FTR Transportation Intelligence reported a higher November order total of 22,745 units, up 42% m/m and 6% higher y/y, the highest net order total since December 2023. FTR reported that a sluggish freight market continues to negatively impact trailer demand, with 2024 shaping up to perform below expectations. Another concern is the possible impacts of tariffs. FTR notes that many trailer parts are made in Mexico, Canada or China.

Dan Moyer, senior analyst of commercial vehicles at FTR, said: “Those tariffs would significantly raise costs for fully assembled trailers imported from Mexico and Canada as well as for critical automotive parts sourced from these regions and China that are essential to U.S.-based trailer production. Resulting supply chain disruptions and/or cost increases could mean higher trailer prices, altered trade cycles and buyer demand patterns, and strains on fleet operator budgets.”

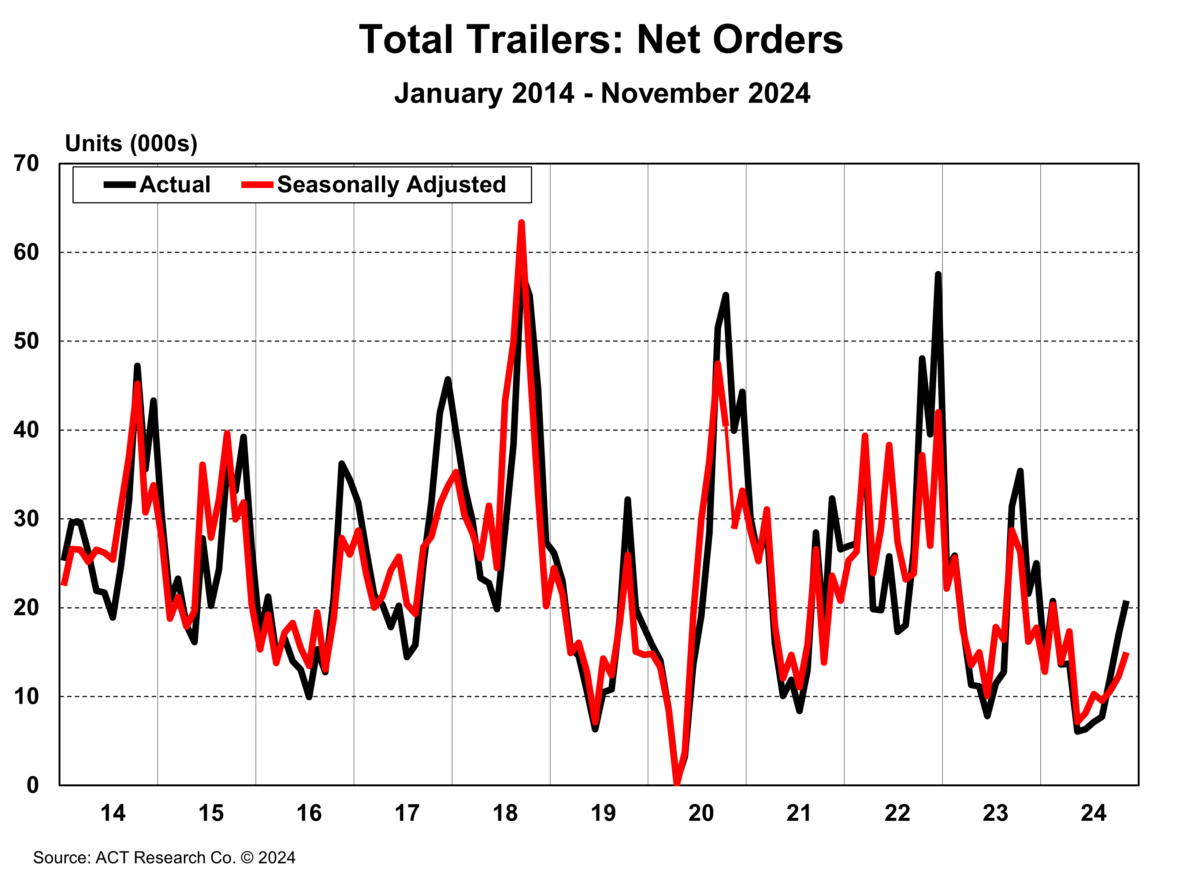

December For-Hire Trucking Index points to a freight market closer to balance

For-hire truckload conditions continued to improve in November, according to the latest data from ACT Research. The diffusion index, which is based on survey data from carriers, measures the degree and directional changes in their operating statistics. A reading above 50 shows expansion while a reading below 50 indicates contraction.

The Volumes Index fell 4.9 points m/m from 56.9 points in October to 52 seasonally adjusted in November. Regarding the decline from October, Carter Vieth, research associate at ACT Research, writes, “The spike last month was likely caused by a surge in demand following hurricanes and the brief ILA port strike, but overall, the US economy remains resilient, and freight volumes are growing.”

The Pricing Index also saw a m/m decline, down 3.6 points seasonally adjusted in November to 51.6. The challenge for pricing remains private fleets and their impacts on the for-hire space. Vieth adds, “Private fleet expansion, which is not captured in this indicator, has resulted in a longer period with the market close to balance than in past cycles.” Vieth said private fleets continue to have an increased share of freight volumes, keeping the for-hire space from turning up.

Driver availability decreased by 2.8 points m/m to 52.8 in November, from 55.6 in October. November is the 30th consecutive month the index has been above 50. Vieth wrote, “Driver availability may fall on the margins as the FMCSA closes a loophole in the Drug & Alcohol Clearinghouse, tightening enforcement. Based on our survey results last month, fleets are doubtful it will have much of an impact.”

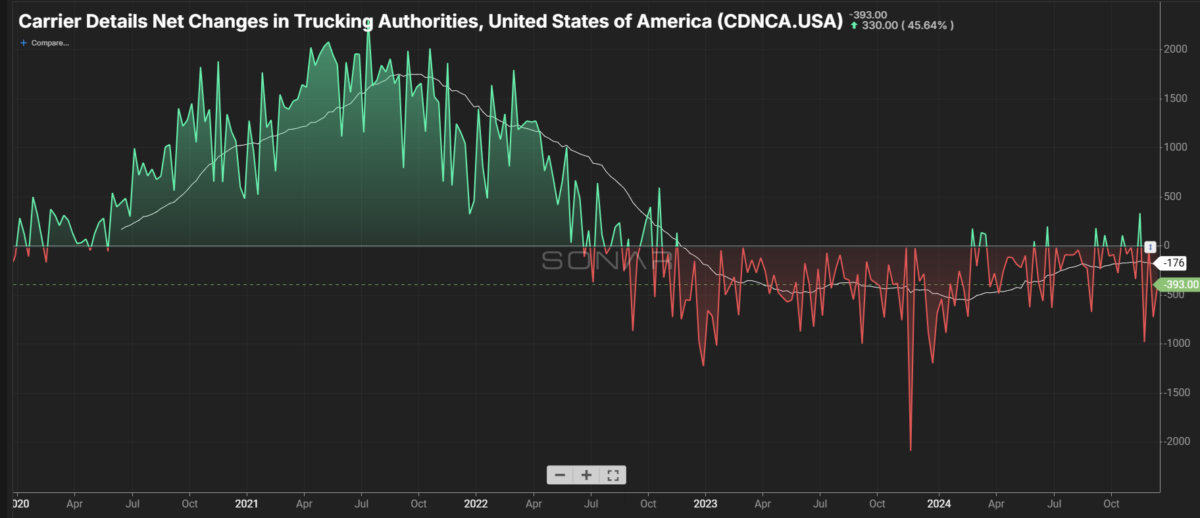

SONAR spotlight: Carrier exits hit seasonal peak

Summary: Carrier Details Net Changes in Trucking Authorities (CDNCA) is experiencing its seasonal trough, a pattern that normally occurs around Christmas. During this period, the number of new operating authorities issued is relatively low, while carrier exits tend to increase. The end of the year often provides operators with a natural transition point, as January and February are typically the most challenging months in terms of trucking demand. Adverse weather conditions, particularly across the Northern regions, can further complicate operations.

While the market has shown signs of improvement — tender rejections recently exceeded 10% for the first time since April 2022 — it remains a highly challenging environment for carriers, even outside seasonal influences. Although no one celebrates business failures, the truckload market has been significantly oversupplied and urgently requires rebalancing.

The CDNCA has reported an average loss of nearly 390 active operating authorities per week since the first week of November. This figure is over 200 higher than the weekly average of the previous seven months but significantly lower than the 629 weekly losses recorded during the same period in 2023. While this suggests a slowdown in carrier exits, the market continues to lose capacity at a steady rate. If historical trends hold, high levels of capacity reduction are likely to persist through February. The return of spring demand may serve as the first meaningful, nonholiday test of the market’s resilience.

The Routing Guide: Links from around the web

Benesch 2024: Pent-up dollars could be big factor in logistics M&A next year (FreightWaves)

Mexico ends border-skipping loophole e-commerce companies frequently exploit (FreightWaves)

NMFTA turns focus on ensuring digital standards and efforts to digitize the freight industry (Commercial Carrier Journal)

FedEx’s divestiture of LTL business marks end of conglomerate era (FreightWaves)

EPA OKs California’s tighter diesel NOx rule; can waiver survive under Trump? (FreightWaves)

Study shows almost all fleets struggle with cost of maintaining compliance (Commercial Carrier Journal)

Like the content? Subscribe to the newsletter here.