Supply Chain & Logistics News December 2nd – December 5th

Experts claim that “Cyber Monday” the Monday following Thanksgiving is one of the busiest days for deliveries followed by the Mondays leading up to Christmas. In 2022, the Postal Service processed more than 11.7 billion mailpieces and packages during the holiday season. In 2023, Amazon delivered around 5.9 billion packages more than UPS and FedEx. All companies and agencies above are heavily investing in technology and tools to deliver packages faster and more efficiently. As the demand sees no end and trade wars wage on, the future of the supply chain will not come without hiccups. Companies will become increasingly dependent on digital tools to sort, track, and mitigate issues at the border. As the holiday season continues it will be interesting to see what unfolds and return here for more news.

Experts claim that “Cyber Monday” the Monday following Thanksgiving is one of the busiest days for deliveries followed by the Mondays leading up to Christmas. In 2022, the Postal Service processed more than 11.7 billion mailpieces and packages during the holiday season. In 2023, Amazon delivered around 5.9 billion packages more than UPS and FedEx. All companies and agencies above are heavily investing in technology and tools to deliver packages faster and more efficiently. As the demand sees no end and trade wars wage on, the future of the supply chain will not come without hiccups. Companies will become increasingly dependent on digital tools to sort, track, and mitigate issues at the border. As the holiday season continues it will be interesting to see what unfolds and return here for more news.

Here’s the Supply Chain & Logistics News for the Week!

China Bans Exports of Key Rare Earth Minerals

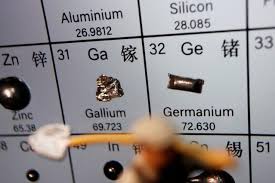

On Tuesday, China banned exports to the United States of the critical minerals gallium, germanium, and antimony, which have widespread military applications. These additional measures strengthen the limits of critical minerals China exports to the U.S. market. A Chinese Commerce Ministry directive on dual-use items with both military and civilian applications cited national security concerns. The order, which takes effect immediately, also requires an additional review of end-usage for graphite items shipped to the U.S. Gallium and germanium are used in semiconductors. At the same time, germanium is also used in infrared technology, fiber optic cables, and solar cells. Antimony is used in bullets and other weaponry, while graphite is the largest component by volume of electric vehicle batteries. This move has ignited new concerns that Bejing could next target other critical minerals, including those with a wide range of usage such as cobalt or nickel. Last year, Chinese customs data show no shipments of wrought and unwrought germanium or gallium to the U.S. this year through October. The year prior, it was the fourth and fifth largest market for the minerals, respectively, a year earlier.

On Tuesday, China banned exports to the United States of the critical minerals gallium, germanium, and antimony, which have widespread military applications. These additional measures strengthen the limits of critical minerals China exports to the U.S. market. A Chinese Commerce Ministry directive on dual-use items with both military and civilian applications cited national security concerns. The order, which takes effect immediately, also requires an additional review of end-usage for graphite items shipped to the U.S. Gallium and germanium are used in semiconductors. At the same time, germanium is also used in infrared technology, fiber optic cables, and solar cells. Antimony is used in bullets and other weaponry, while graphite is the largest component by volume of electric vehicle batteries. This move has ignited new concerns that Bejing could next target other critical minerals, including those with a wide range of usage such as cobalt or nickel. Last year, Chinese customs data show no shipments of wrought and unwrought germanium or gallium to the U.S. this year through October. The year prior, it was the fourth and fifth largest market for the minerals, respectively, a year earlier.

Shell and Equinor Plan Merger of Their British North Sea Assets

Shell and Equinor announced plans to merge their British North Sea assets into a 50-50 joint venture, creating the basin’s largest oil and gas company. Based in Aberdeen, the new entity aims to pool resources, reduce costs, and boost profitability while increasing production from 140,000 boed in 2025 to 200,000-220,000 boed within five years. Equinor will contribute significant tax savings, and Shell’s larger production will enhance cash flow as the venture develops projects, including the $3.8 billion Rosebank oilfield. The move reflects ongoing challenges in the maturing UK basin, where production has declined significantly from its peak, and the windfall tax has pressured companies to reduce investment. The deal, expected to close by 2025, will help the companies navigate a declining production environment while retaining control over certain assets, such as Shell’s floating wind projects and Equinor’s hydrogen and carbon capture ventures.

Shell and Equinor announced plans to merge their British North Sea assets into a 50-50 joint venture, creating the basin’s largest oil and gas company. Based in Aberdeen, the new entity aims to pool resources, reduce costs, and boost profitability while increasing production from 140,000 boed in 2025 to 200,000-220,000 boed within five years. Equinor will contribute significant tax savings, and Shell’s larger production will enhance cash flow as the venture develops projects, including the $3.8 billion Rosebank oilfield. The move reflects ongoing challenges in the maturing UK basin, where production has declined significantly from its peak, and the windfall tax has pressured companies to reduce investment. The deal, expected to close by 2025, will help the companies navigate a declining production environment while retaining control over certain assets, such as Shell’s floating wind projects and Equinor’s hydrogen and carbon capture ventures.

EU Adopts Ban on Products Made with Forced Labor

Last week, the European Union Council adopted a regulation that prohibits products in the market made using forced labor. The ban forbids the placing and making available on the Union market, or the exit from the Union market, of any product made using forced labor. This is the final step in the decision-making procedure. This regulation creates the framework which is the foundation to base legal action targeting products made with forced labor on the internal market. The Commission will establish a database identifying areas or products at risk of forced labor to assist competent authorities in evaluating potential violations of this regulation. Depending on the identified risks, investigations may be initiated by the Commission for cases involving forced labor outside the EU or by member state authorities for instances occurring within their jurisdiction. After being signed by the President of the European Parliament and the President of the Council, the regulation will be published in the official journal of the European Union and will enter into force on the day following its publication, it will apply 3 years after the date of entry into force.

Last week, the European Union Council adopted a regulation that prohibits products in the market made using forced labor. The ban forbids the placing and making available on the Union market, or the exit from the Union market, of any product made using forced labor. This is the final step in the decision-making procedure. This regulation creates the framework which is the foundation to base legal action targeting products made with forced labor on the internal market. The Commission will establish a database identifying areas or products at risk of forced labor to assist competent authorities in evaluating potential violations of this regulation. Depending on the identified risks, investigations may be initiated by the Commission for cases involving forced labor outside the EU or by member state authorities for instances occurring within their jurisdiction. After being signed by the President of the European Parliament and the President of the Council, the regulation will be published in the official journal of the European Union and will enter into force on the day following its publication, it will apply 3 years after the date of entry into force.

Descartes Releases Findings From its 2024 Supply Chain Intelligence Report

Descartes Systems Group’s 2024 Supply Chain Intelligence Report highlights the escalating challenges faced by global supply chain leaders, with 48% of respondents identifying rising tariffs and trade barriers as their top concern, followed by supply chain disruptions (45%) and geopolitical instability (41%). These issues persist across companies of all sizes but are particularly acute for businesses expecting high growth. The study underscores the urgent need for organizations to enhance their supply chain resilience through advanced analytics, technology-driven insights, and strategic planning to navigate evolving tariffs, trade policies, and market dynamics. Conducted across key trading regions, the survey gathered insights from 978 leaders, emphasizing the importance of robust global trade intelligence for competitive and compliant operations.

Descartes Systems Group’s 2024 Supply Chain Intelligence Report highlights the escalating challenges faced by global supply chain leaders, with 48% of respondents identifying rising tariffs and trade barriers as their top concern, followed by supply chain disruptions (45%) and geopolitical instability (41%). These issues persist across companies of all sizes but are particularly acute for businesses expecting high growth. The study underscores the urgent need for organizations to enhance their supply chain resilience through advanced analytics, technology-driven insights, and strategic planning to navigate evolving tariffs, trade policies, and market dynamics. Conducted across key trading regions, the survey gathered insights from 978 leaders, emphasizing the importance of robust global trade intelligence for competitive and compliant operations.

Chinese Automakers Lean Into Hybrids to Dodge Tariffs

Chinese automakers are increasing exports of hybrid vehicles to Europe and introducing more hybrid models as a strategy to bypass the European Union’s recent tariffs on Chinese electric vehicle (EV) imports. These tariffs, implemented to counteract what the EU perceives as unfair subsidies, do not apply to hybrids, prompting manufacturers like BYD and Geely to focus on plug-in hybrids and conventional hybrids for the European market. Hybrid exports from China to Europe have surged, tripling between July and October 2024 compared to the same period in 2023, as buyers see hybrids as a cost-effective alternative to fully electric or gasoline vehicles. Chinese automakers are also considering establishing production facilities in Europe to further reduce tariff-related costs, while Japanese manufacturers, facing overcapacity in China, are also leveraging the growing demand for hybrids in Europe. Analysts predict continued momentum for hybrid exports as Chinese automakers aim to address domestic overcapacity and secure a competitive foothold in Europe without triggering further trade restrictions.

Chinese automakers are increasing exports of hybrid vehicles to Europe and introducing more hybrid models as a strategy to bypass the European Union’s recent tariffs on Chinese electric vehicle (EV) imports. These tariffs, implemented to counteract what the EU perceives as unfair subsidies, do not apply to hybrids, prompting manufacturers like BYD and Geely to focus on plug-in hybrids and conventional hybrids for the European market. Hybrid exports from China to Europe have surged, tripling between July and October 2024 compared to the same period in 2023, as buyers see hybrids as a cost-effective alternative to fully electric or gasoline vehicles. Chinese automakers are also considering establishing production facilities in Europe to further reduce tariff-related costs, while Japanese manufacturers, facing overcapacity in China, are also leveraging the growing demand for hybrids in Europe. Analysts predict continued momentum for hybrid exports as Chinese automakers aim to address domestic overcapacity and secure a competitive foothold in Europe without triggering further trade restrictions.

Song of the week: