The 2020s are already halfway over.

Crazy right?!

That’s what I’m supposed to say as a middle-aged person, even with the knowledge that father time is undefeated.

It’s hard to believe we’re five years removed from the start of the pandemic. We’ve lived through a wild half-decade in the markets in that time.

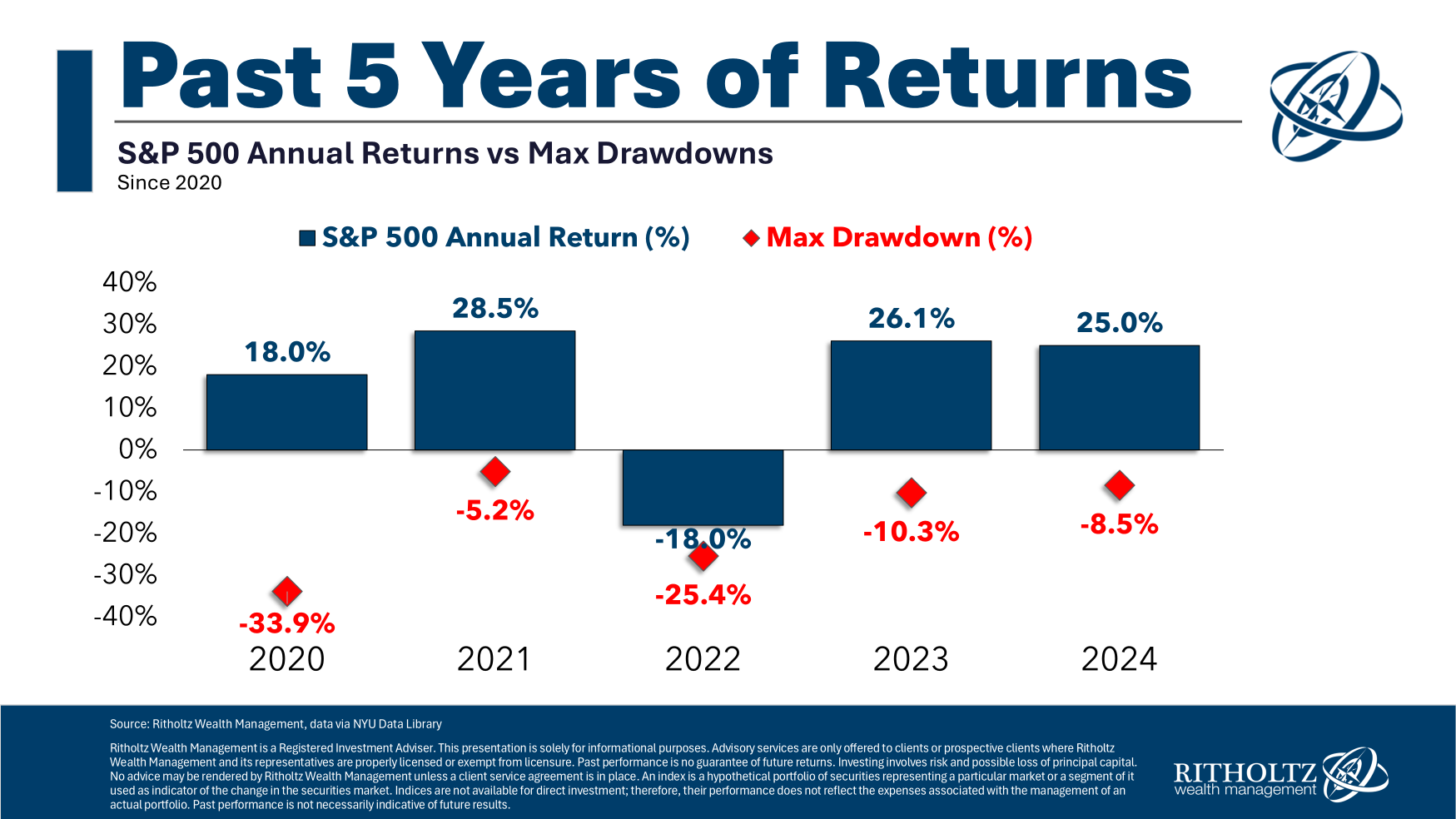

Every year in the 2020s has seen a big move. Here’s a look at the year-end returns along with intra-year drawdowns this decade:

Big moves all around.

A massive crash in early 2020 was followed by a huge recovery that saw stocks rise by nearly 20% at year-end. Then we had a near-30% return in 2021 which was followed by a bear market in 2022. In 2023 there was a 10% correction but the stock market still rose 26%. A 25% gain followed that in 2024.

There have been no “normal” or “average” years to speak of this decade. Every year has experienced wide swings higher or lower and sometimes one of each.

And this five-year run followed a +31% year in 2019. 2018 finished the year down 5% but there was a near 20% drawdown to get there. And 2017 was +22%.

Volatility is often associated with losses but it works in both directions. The 2020s have been filled with downside and upside volatility. Luckily, most of it has been to the upside.

It’s just that the cycles this decade seem to occur faster than they did in the past.

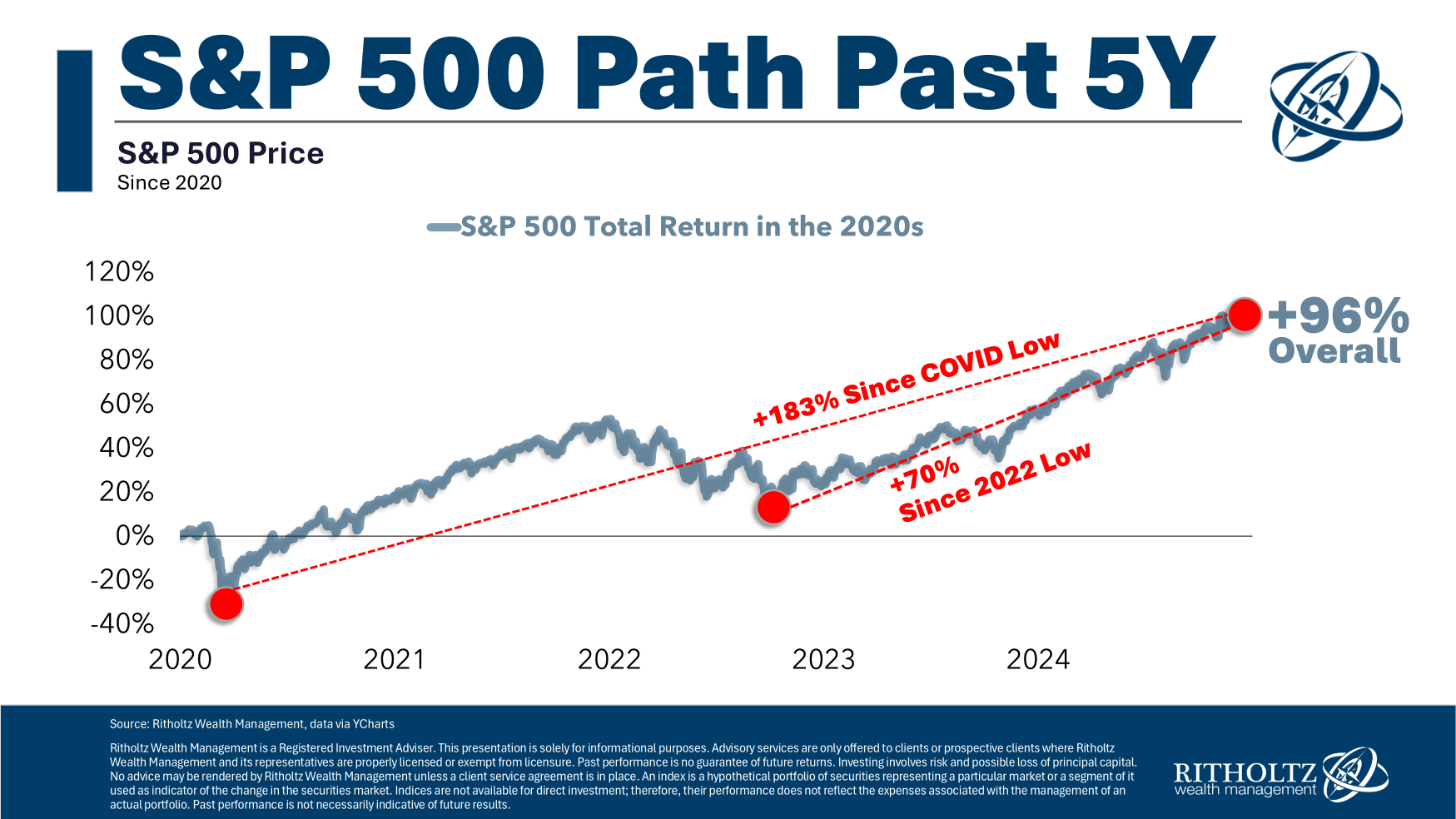

The S&P 500 is up nearly 100% in total for the decade which is good enough for 14.5% annualized returns. But look at the path of the S&P 500 in the first five years of the 2020s:

We’ve seen massive gains from the pandemic and 2022 bear market lows. So while the gains this decade have been extraordinary, there have been two wonderful buying opportunities with a 34% crash in early-2020 and a 25% bear market in 2022.

No one can time those kinds of drawdowns with precision but if you dutifully invested in the stock market on a regular basis you’ve made out pretty well in the 2020s.

If you put $500 a month into the S&P 500 every single month this decade you would have turned almost $30,000 of contributions into more than $45,000 by the end of 2024.

That’s good enough for an IRR of more than 17%! Not bad.1

I don’t know what the rest of the decade has in store for investors in the U.S. stock market. But with near-15% annual returns in the first half of the decade, the S&P 500 would only need to see 5.5% annual returns from 2025-2029 to finish the 2020s at the long-term average of around 10% per year.

If you already have a bunch of money in the market, you probably hope returns will be even better than that going forward.

If you are going to be a net saver in the years ahead, you should hope for more volatility and bear markets.

I’ll see you in five years for a post-2020s check-in.

Further Reading:

Are U.S. Stock Overvalued?

1Check out Nick’s DCA calculator here.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.