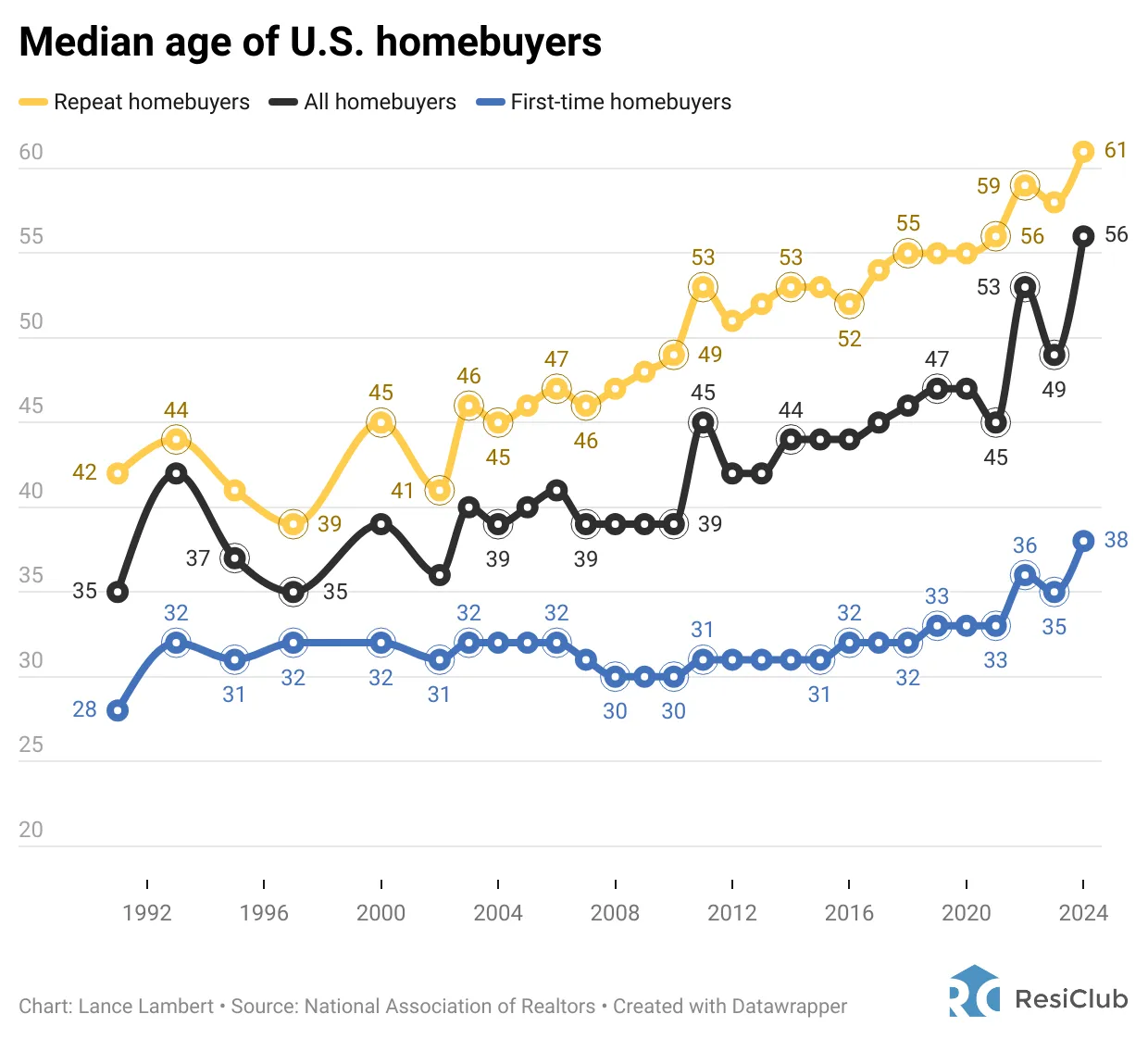

I recently came across an eye-opening chart by the National Association of Realtors showing that the median age of first-time U.S. homebuyers is now 38 years old. That’s a significant jump from 30 years old between 2008 and 2010. Meanwhile, the median age for repeat buyers has risen to 61 years old.

What is going on here?

These numbers astound me because life is far too short to delay buying a home for that long. After COVID, the median life expectancy in the U.S. is getting shorter, not longer. Most people buy their first home with the intention of settling down. Yet if you’re only making this commitment at 38, you may not get to enjoy homeownership in the way you had envisioned.

I understand that rising home prices and high mortgage rates are the main factors contributing to this trend, making affordability harder. However, this post is not targeted at those where affordability is their main issue.

Instead, this post is directed at those who can afford to buy a home, but wait for the “perfect price” before taking action. The problem is that waiting indefinitely can delay important life milestones, making it harder to retire early, start a family, and fully enjoy the benefits of homeownership.

Your Diminishing Hopes Of Retiring Before 60

Waiting for the perfect price to buy a home can push back your retirement timeline significantly. If you purchase your first home at 38, you’ll likely take out a 30-year mortgage—after all, about 95% of homebuyers do, even though I prefer an adjustable-rate mortgage (ARM) instead. Matching your homeownership duration with a lower fixed-rate makes more sense.

By the time your mortgage is paid off at 68, you may have already worked for five or more years past the traditional retirement age. If you had bought a home at 28 instead, you would have had a paid-off house by 58, allowing for a much more flexible and enjoyable retirement.

Of course, some people might have aggressively saved and invested between 18-38 to achieve financial independence before buying a home. However, that is a smaller percentage of the population. Making a home purchase at 38 often means depleting a significant amount of cash and investments, potentially reversing any financial independence they had achieved.

I experienced this firsthand after purchasing our home in Q4 2023 with cash from stock and bond sales. This decision caused my passive investment income to drop, leaving me at the worst point 25% short of covering my desired household expenses. Now, I must spend the next 3-4 years making up for this deficit, delaying my financial goals.

Starting A Family May Be More Difficult

Many people aim to buy a home before having children, seeking stability before expanding their family. However, delaying homeownership can make it harder to start a family at an optimal age.

Fertility challenges increase after age 35, and women over this age are categorized as “geriatric” in maternity wards. My wife and I experienced this firsthand during the births of both our children in San Francisco. Many couples in our network also struggled with conception as they waited longer to settle down.

If you plan to buy a home before starting a family but don’t want to risk fertility complications, I recommend beginning your family planning once you have financial stability and the right partner, rather than waiting for the “perfect” home purchase.

A net worth of at least two times your gross household income is a reasonable benchmark before having children. In general, the greater your wealth before having children, the less stressed you’ll be. Have a net worth goal before having kids to keep you focused.

Of course, it’s perfectly fine to start a family and rent. Just make sure you find a place that is owned by a landlord who wants long-term tenants.

The Flaws In Waiting For The Perfect Price

One of the biggest reasons people delay homeownership is the belief that a better price will come along. But market timing is nearly impossible. Even if you correctly predict a market bottom, you may struggle to find the right home at that time. And if the perfect home does appear, chances are others will be bidding on it, driving up the price immediately.

Instead of trying to time the market, buy a home when you can afford to do so. If you meet at least two of my three home-buying rules in the 30/30/3 framework, you’re in a good position. Additionally, ensure you plan to own the home for at least five years due to high transaction costs.

Homeownership helps protect against inflation by stabilizing your housing costs. Renting indefinitely exposes you to rent increases and instability. When you own, you have control over your living situation and can enjoy the security of not being forced to move due to a landlord’s decisions.

When you rent, your return on rent is always negative 100 percent. Yes, you get a place to stay, but nothing more. You don’t get the option to live for free or actually make money from shelter.

Other Examples Where Waiting For A Better Price Can Be Detrimental

Being cost-conscious is important, but waiting for the lowest possible price isn’t always the best financial decision. Here are other areas where waiting can negatively impact your quality of life:

1. Emotional Well-Being & Relationships

Sometimes, spending more for convenience—like taking a direct flight instead of enduring long layovers—can significantly improve your mental and physical health. Hiring help, such as a nanny or house cleaner, can free up time to focus on your career, family, or self-care. The cost is worth the reduced stress.

2. Medical Treatment

Health is priceless. Delaying necessary medical treatment in hopes of a lower cost can lead to severe complications, higher expenses, and worse outcomes. Preventative care, regular check-ups, and timely treatments save money and lives in the long run.

3. Quality Time & Experiences

Traveling with loved ones, attending milestone events, and creating lasting memories are invaluable. Skipping experiences like taking your kids to Disneyland or missing out on a major concert to save money often leads to regret. You can always earn more money, but lost time is irreplaceable. You likely won’t be able to hike the 20 mile Incan trail in your 70s.

4. Career & Business Opportunities

A conference, course, or networking event could change the trajectory of your career. Waiting for a price drop might mean missing out on key connections or career advancement opportunities.

5. Essential Home or Car Repairs

A minor leak today can turn into major water damage tomorrow. A small car issue can escalate into an expensive breakdown. Waiting for a “better deal” on repairs often results in greater financial losses down the road.

6. High-Quality Work Tools

The right equipment can significantly boost productivity and earnings. A slow laptop or outdated software can waste hours of valuable work time. I’m experiencing this firsthand with my 8GB MacBook Pro—it slows down constantly, killing my efficiency. A new one would pay for itself in improved productivity, but I can’t get myself to buy a new one since it’s only five years old.

7. Education & Skill Development

Investing in learning can lead to higher lifetime earnings. A book on investing and personal finance could yield thousands in future gains. Waiting to save $15 during a sale could result in lost opportunities worth 1,000 more.

8. Spending On Health & Fitness

A good mattress, ergonomic chair, or gym membership can prevent long-term health issues. Poor sleep or a sedentary lifestyle leads to medical expenses far exceeding the initial cost of preventative measures. Are you really going to sacrifice your sleep for 11 months to wait for that holiday mattress sale?

9. Childhood Milestones

Kids grow up quickly. Skipping meaningful experiences to save money—such as extracurricular activities, vacations, or even a quality preschool—can mean missing out on key developmental opportunities.

If there’s another thing worth spending money on, besides a great primary residence, it’s on your kids. Once they leave the house, 80% – 90% of the time you’ll ever spend with them will be gone for good.

10. Hiring Skilled Professionals

Whether for home renovations, childcare, or financial advising, waiting for a lower price can mean losing access to top talent. Skilled professionals are in high demand, and the cheapest option is rarely the best.

You Don’t Always Have To Optimize For Savings – Pay Up For Convenience

Instead of always optimizing for savings, use your growing wealth to enhance your lifestyle and convenience. Pay the extra 20 cents per gallon for gas instead of driving 10 more minutes to save a few bucks. Choose direct flights over layovers to save time and reduce stress. Hire a house cleaner to free up hours for family, hobbies, or relaxation. Practicing the habit of using your wealth to improve your life is just as important as building it.

Before buying my home in 2023, I analyzed the probability of it coming back on the market if I didn’t move forward. The soonest possible resale would be mid-2025, based on the seller’s plans. His daughter was graduating high school in 2025 and he mentioned he’d want to move back to his country of origin.

However, I couldn’t predict if the price would still be within reach. If the stock market performed well in 2024 and 2025, demand could push prices even higher, making it harder for me to buy. At the same time, if I bought the house I would lose out on further stock market gains. In the end, I prioritized certainty over potential savings.

Although I probably would have made more money by waiting, I have no regrets. I didn’t put my life or my family’s comfort on hold for two years

What Are Your Thoughts?

Are you surprised by the rising median age of homebuyers? How much of it is due to affordability versus waiting for better prices? What other areas of life have you seen people delay for financial reasons, only to realize it wasn’t worth it? Let me know your thoughts!

Diversify Into High-Quality Private Real Estate

Stocks and bonds are classic staples for retirement investing. However, I also suggest diversifying into real estate—an investment that combines the income stability of bonds with greater upside potential.

Consider Fundrise, a platform that allows you to 100% passively invest in residential and industrial real estate. With almost $3 billion in private real estate assets under management, Fundrise focuses on properties in the Sunbelt region, where valuations are lower, and yields tend to be higher.

With a robust economy, a strong stock market, pent-up demand, and attractive prices, I expect commercial real estate prices to continue to recover. I’ve personally invested over $300,000 with Fundrise, and they’ve been a trusted partner and long-time sponsor of Financial Samurai. With a $10 investment minimum, diversifying your portfolio has never been easier.

Subscribe To Financial Samurai

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Your shares, ratings, and reviews are appreciated.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise.